As Bitcoin (BTC) steadily makes its means towards its present all-time excessive (ATH) of $124,128, optimism appears to be returning to the market. Nonetheless, contemporary information from Binance exhibits that BTC’s beneficial properties barely outweigh the dangers posed by the digital asset’s volatility.

Bitcoin Sustaining A Danger-Reward Steadiness

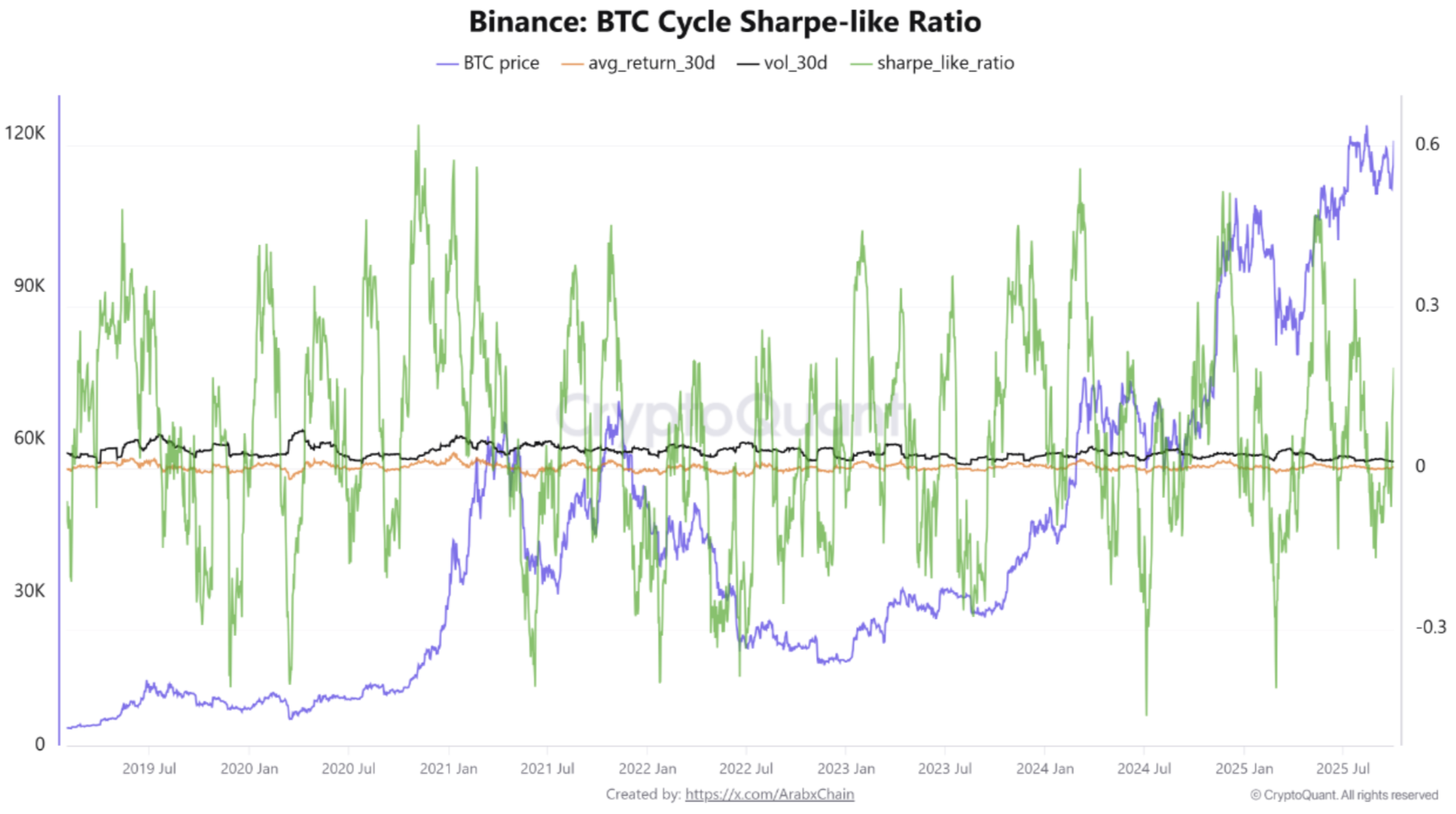

In keeping with a CryptoQuant Quicktake submit by contributor Arab Chain, newest information from Binance – the world’s main cryptocurrency buying and selling platform when it comes to liquidity – means that BTC is presently sustaining a risk-reward stability.

Associated Studying

Particularly, the Sharpe-like ratio on Binance presently stands at 0.18, a determine very near impartial territory. To clarify, a Sharpe-like ratio measures how a lot return an funding generates relative to the chance it takes, much like the Sharpe ratio however usually utilizing adjusted benchmarks or danger measures.

When the Sharpe-like ratio is above 0.5, investing in Bitcoin turns into engaging for the reason that potential returns outweigh the dangers. Quite the opposite, a unfavourable studying of the ratio discourages buyers from taking dangers, since volatility exceeds returns.

Throughout 2024, when the cryptocurrency market was largely weak and risky, the Sharpe-like ratio spent more often than not within the unfavourable territory. In distinction, the ratio reached elevated ranges, signaling a powerful uptrend, initially of 2025.

Presently, the Bitcoin market is buying and selling between the 2 extremes – the market is neither harmful nor in a robust uptrend. Notably, the market seems to be in a section of equilibrium and accumulation, because it trades near $119,000. Arab Chain added:

The newest figures present that the 30-day common return stands at simply 0.26%, highlighting that the market is just not delivering outsized beneficial properties; buyers coming into now are more likely to see solely modest earnings relative to danger. In the meantime, 30-day volatility is round 1.37%, which signifies a pure, average degree of worth fluctuation – not excessively calm however not alarmingly unstable both.

BTC Wants A Catalyst For Subsequent Leg Up

The CryptoQuant analyst added that the BTC market is presently awaiting a bullish catalyst or robust inflows to increase its uptrend. Nonetheless, if the Sharpe-like ratio falls under zero once more, then a interval of worth correction might comply with.

Associated Studying

On the flipside, the ratio sustaining above 0.5 for a number of days – coupled with a worth breakout above the $120,000 to $122,000 vary on wholesome quantity – would counsel a contemporary upward development for the highest cryptocurrency by market cap.

Latest on-chain information hints towards a possible rally setup for BTC. Notably, the short-term holder (STH) spent output revenue ratio (SOPR) just lately recovered barely to 0.995.

That mentioned, Bitcoin should defend the vital $90,000 assist degree to keep away from coming into a brand new bear market. At press time, BTC trades at $118,788, up 1.3% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com