It’s no secret that a few of the main inventory market indices have been screaming greater not too long ago. In the event you take a look at an S&P500 day by day chart for instance, it’s been on fireplace for effectively over a yr now, particularly because the second half of 2017. To the outsider who doesn’t actively commerce, it could appear tremendous straightforward to benefit from these one-way markets, however not so quick.

It’s no secret that a few of the main inventory market indices have been screaming greater not too long ago. In the event you take a look at an S&P500 day by day chart for instance, it’s been on fireplace for effectively over a yr now, particularly because the second half of 2017. To the outsider who doesn’t actively commerce, it could appear tremendous straightforward to benefit from these one-way markets, however not so quick.

For these of us who’ve been across the buying and selling block a couple of instances, we all know the sensation of the deer within the headlights throughout these runaway strikes; you retain ready for a pullback to get on-board, however the market simply retains going greater or decrease, with out you. Or, you retain telling your self “This development has gone too far, it HAS to reverse quickly, proper?!” So, this clearly begs the query, how can we benefit from these ‘runaway tendencies’?

The next factors will get you on top of things on the right way to correctly sort out and benefit from the wonder and energy of a runaway trending market…

What’s a runaway development?

Firstly, you have to be clear on what a runaway development truly appears like. While there is no such thing as a universally agreed upon definition of what constitutes a runaway development, it’s pretty apparent as to when there’s one and when there isn’t.

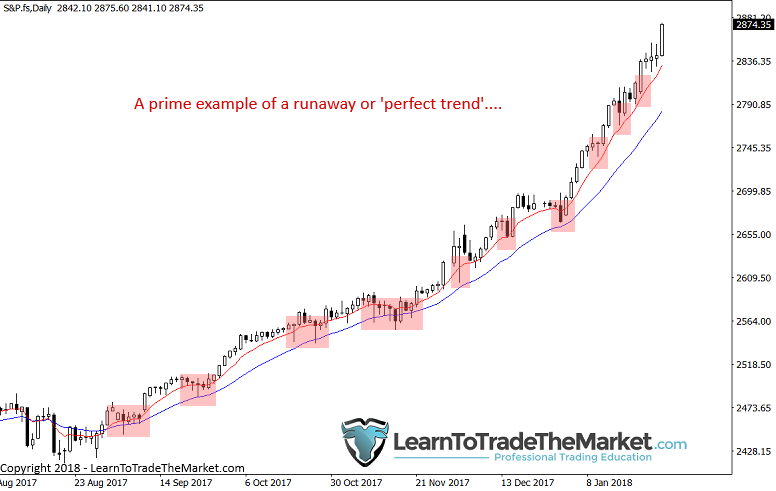

There’s a idea that I name a ‘good development’ whereby a market is respecting the reversion to the imply (assume pullbacks to shifting averages, see course for extra) and close by horizontal ranges because it repels or bounces cleanly away from them on each try at a rotation (retracement). I focus on this idea a bit extra in an article I wrote on the right way to establish the development on charts. Now, let’s take a look at excellent, dare I say ‘good’ instance of a runaway or ‘good development’ that has been underway for effectively over a yr within the S&P500 index…

One idea to grasp about these runaway tendencies is that one of many traits they exhibit may be very small pullbacks or retraces again to worth. For these of you new to this, a retrace again to worth merely means worth pulling again to a help (in uptrend) or resistance degree (in downtrend), this may also be referred to as reversion to the imply as talked about beforehand. So, to place it succinctly, the stronger the development, the shallower the pullbacks shall be inside it. The necessary consequence of this phenomenon, is that when a market isn’t pulling again a lot (as a result of it’s in a really sturdy development) and worth is capturing to new highs or lows with no close by apparent horizontal ranges (particularly as within the case of recent all-time highs or lows, just like the S&P500 proper now) to sluggish its motion, the market can EASILY proceed surging greater or decrease.

So, it’s form of a constructive suggestions loop if you’ll; worth is shifting aggressively in a single path with little to no pullbacks as a result of the underlying fundamentals of the market are very sturdy and since there are not any technical ranges to impede it. Increasingly individuals pile on and worth simply retains crusing in the identical path, providing you little or no in the best way of buying and selling the pullbacks, but when you know the way to benefit from this, it may be very (dare I say) straightforward cash.

One necessary facet of runaway tendencies that’s typically neglected is that closing costs are essentially the most related worth issue within the technical evaluation of a market. Now, what precisely do I imply by that? Effectively, in a robust development, we have to pay extra consideration to the closing costs than some other worth, as a result of that closing worth is prone to be a clue as to what’s going to occur subsequent (studying the value motion). Closing costs imply extra than simply the place market has been, the shut is the data that lets us know if one thing is confirmed or failed.

When making an attempt to find out tendencies and in search of indicators of runaway / sturdy tendencies which can be beginning up, the weekly chart takes priority…however watch out, candlestick charts can ‘cover’ this data or make it tougher to see at first. For that reason, I all the time scan by a line chart on the day by day and weekly in an try and establish a market that’s starting to development or is already trending. It’s a lot simpler to see if a robust development is underway in a line chart (utilized to shut) as a result of it filter out all of the wicks / tails of the candles and simply reveals you the path and key ranges and what occurred on the ranges. In the event you don’t imagine me, pull up a day by day candle chart after which swap it to a day by day line chart, you will note new data you most likely didn’t see initially.

Watch the principle key weekly ranges in a longtime development. This may shield towards shake-outs and supply a a lot clearer image for filtering all of the wicks of candles. To do that, you possibly can swap over to a line chart as it can filter out the wicks / tails of worth bars to offer us a smoother view of the general image.

One other instance of a candle / bar chart vs. a line chart. It’s sensible to verify the road chart to see a transparent image of the development…

Methods to commerce runaway tendencies

Okay, so now that we all know what a runaway development is and a fundamental strategy to establish them, let’s focus on how one can benefit from their energy, so that you’re now not that ‘deer within the headlights’.

Maybe the most important factor to grasp is that there received’t be main pullbacks to ranges in a really sturdy development. So, relatively than simply ready round for a pullback that by no means comes, let’s see how we are able to get on-board a strongly trending market.

The first factor you will give attention to is intraday pullbacks, I’m speaking right here concerning the 4 hour and 1-hour chart time-frame with worth motion indicators to substantiate entries. You will need to apply the 8 and 21 day by day chart exponential shifting averages (emas) as a result of worth will typically pull again to this dynamic worth or help / resistance space earlier than shifting on with the development once more. We are able to additionally mark short-term or close by horizontal help and resistance ranges to look to commerce from them. One other good choice is breakouts, particularly inside bar breakouts in a runaway development, these are pretty frequent and allow you to benefit from a development that isn’t pulling again. Let’s take a look at some examples….

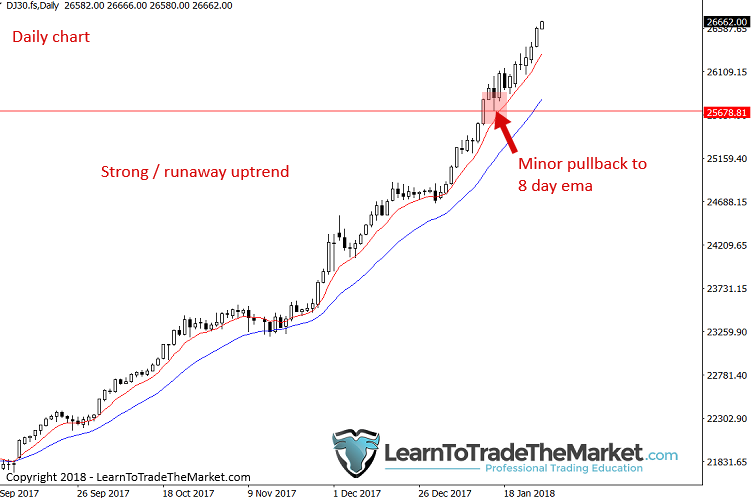

Within the chart beneath, we see a pleasant instance of a latest and present runaway development underway within the Dow Jones Index. Pay shut consideration to the small pullbacks that occurred to the 8 and 21-day emas (purple and blue strains) as these are going to be your most typical pullback alternatives in such a robust development. Word the horizontal degree as it will likely be necessary on the following chart…

Subsequent, take a look at the 4-hour chart of the identical market from above. The pullback we mentioned above to the 8-day ema resulted in a 4-hour pin bar purchase sign as we see beneath. That is how one can efficiently catch a runaway development! You will have the development, then all you want is a degree or a sign, as in my T.L.S buying and selling method, right here we had a robust development and a robust sign, increase.

Within the subsequent chart, we’re a facet by facet latest instance (January 24th, 2018) of the right way to use the 1-hour chart to search for high-probability entries right into a runaway development. This is similar chart as above, the DOW30, we are able to see a minor pullback final week to the 8-day ema on the left, which resulted within the very good pin bar sign on the 1-hour chart on the fitting. Whenever you see a sign like this kind, it actually ought to be a no brainer to enter it, set cease beneath pin low and print some cash…The secret is ready for a sign like this to type and never leaping in on low-quality / non-obvious indicators or on something below a 1-hour time-frame…

Vital observe: Now, it’s necessary to grasp that we aren’t “intraday buying and selling” by doing the above, as an alternative, we’re utilizing 4 hour or 1 hour or day by day charts to substantiate entries on trades which will final for days or perhaps weeks. Simply since you enter a commerce on an intraday chart doesn’t make you a day dealer! Utilizing an intraday chart to search out an entry into a robust day by day or weekly chart development is just a strategy to refine and discover an entry right into a runaway development, however we aren’t leaping out and in of the market continually as a day dealer would.

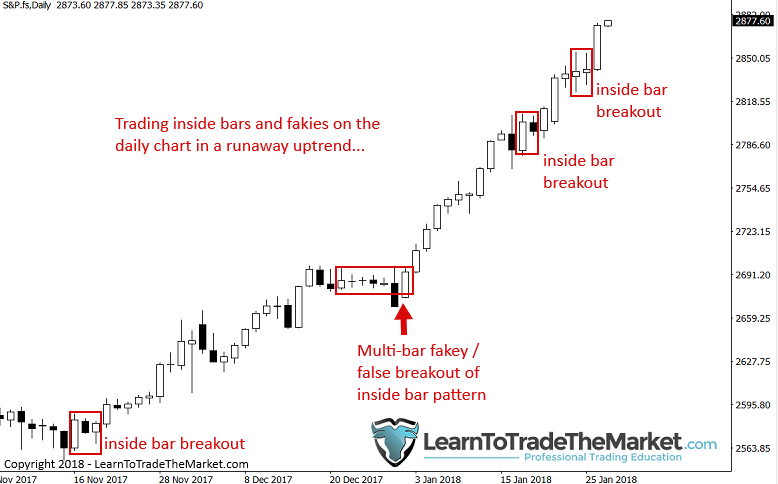

To benefit from breakouts in a runaway development, my favourite performs are inside bar patterns and my proprietary fakey buying and selling sign. Inside bars are frequent on the day by day chart in a really sturdy / runaway development as a result of the market will make a short pause after its most up-to-date transfer earlier than capturing greater (uptrend) or decrease once more (downtrend). Beneath, you possibly can see some examples of latest inside bar breakouts and a multi-bar fakey sample that led to a development continuation and offered savvy worth motion merchants a low-risk and really excessive reward potential commerce entry…

The psychology of runaway tendencies.

The most important factor to recollect relating to your mentality when coping with very strongly trending markets is to not over assume. Markets go additional than we regularly assume they are going to, so keep in mind to commerce with development till it clearly ends!

One of many essential drivers of enormous sustained tendencies is the truth that the market continues to weed-out the individuals betting towards it (there are greater than you’d assume), keep in mind that when a dealer goes quick and bets towards a bull market, if the market goes up they need to cowl that place by shopping for, this in flip results in additional bullishness and a swarm of contemporary orders. These runaway tendencies can gas themselves on this approach for a really very long time, so don’t wager towards them!

Similar to a freight practice is extremely tough to cease and takes a very long time to decelerate not to mention reverse path, a strongly trending market is a power to be reckoned with. Its momentum and energy additionally make it the perfect market situation to commerce in and supply the closest factor for ‘straightforward cash’ that you can see within the buying and selling realm. Sadly, these runaway tendencies don’t come round fairly often, so after we spot a market in a runaway development we have to know what to do and we have to act decisively, and the methods mentioned right here right this moment are a superb place to begin for you.

Conclusion

Lastly, even when we all know the bias of the charts and that bias is extraordinarily apparent (like proper now on the inventory market), we regularly nonetheless received’t have sufficient confidence to tug the set off on a commerce. Merchants typically freeze in a state of disbelief, saying to themselves “This market can’t go any additional, it simply has to reverse!”. In the event you do that, you will lose. Don’t make up eventualities that you just assume “must occur out there”, as an alternative, give attention to what is definitely taking place and simply use that to your benefit till it doesn’t work anymore.

I’ve present in my 14 + years buying and selling that runaway tendencies like these proven above are the most effective alternatives to generate income, as a result of as I’ve already identified, the sturdy sustained strikes (up or down) typically preserve going to date past what appears rational or logical, attributable to greed, euphoria and folks being compelled to cowl unhealthy bets they’ve made towards the market (in addition to underlying fundamentals supporting the development). With the mixture of technical evaluation data and psychological data we touched upon right here right this moment, as merchants, we now have an edge and may exploit it when it’s current. These items are perfected by years of display time and watching these market situations unfold, it’s not one thing I can train you in a single day, however you possibly can actually apply the ideas I train in my programs and on this website on the whole that will help you spot runaway tendencies and revenue massively from them.

What did you consider this lesson? Please share it with us within the feedback beneath!