Hello everybody,

A fast replace on Aletheia, my AI-driven analysis & buying and selling venture.

✅ Check Part v1 — Abstract

-

Interval: early July → 3 Aug 2025 (~1.5 months).

-

Threat mannequin: fastened 0.5% per commerce.

-

Efficiency: +$2,274.02 internet (≈ +4.55% on 50k). Revenue issue 2.98, win price 65% (13/20), largest win $889.92, largest loss −$256.93.

-

Drawdown: Max steadiness DD 0.67% (−$339.55).

-

Positioning: 20 shorts, 0 longs throughout v1.

-

Finish snapshot: Steadiness $52,274.02, Fairness $52,803.14 at report time.

Through the first month Aletheia climbed to roughly +5%, then a quick shedding cluster appeared. I paused v1 and up to date the agent to filter the reasoning patterns linked to these losses.

Full Commerce Historical past and Account stories are connected so you may audit each ticket.

🧭 Aletheia Internet App — Public Preview

Discover how Aletheia turns world information into reasoned hypotheses and curated, broker-agnostic commerce setups.

🧩 How the agent works (House)

A visible, end-to-end circulation of the pipeline with guardrails:

- All the time-on monitor → enrich → speculation tree → proof engine → place synthesis → execution & governance.

- Gatekeeper checks at key handoffs; clear standing and outcomes.

📊 Dashboard

Dwell situational consciousness in a single place:

- KPIs & trendlines (win/loss, RR distribution, publicity, setup throughput).

- World Impression Map (country-level choropleth by mentions, zoom/hover, high areas).

- Protection by sectors, themes, areas; latest notable occasions and outcomes.

🧠 Occasion Explorer

Drill from information occasions to full reasoning trails.

- Filters: Fast (In the present day / This week / This month) and Superior (date vary, themes, areas, sectors, textual content search, outcomes).

- Occasion web page: context & growth (entities/areas/sectors/themes), progress, selections, department & place counts.

- Department web page: speculation particulars, proof & quotation path, gatekeeper verdicts, route & latency, plus generated positions.

💹 Commerce Setup Explorer

Browse all setups and bounce straight to the reasoning that produced them.

- Filters: date, image(s), route, standing (open/closed/expired/discarded), consequence labels (e.g., tp2_hit , sl_hit ).

- Inline charts and compact playing cards (thesis, entries/targets/stops, threat mannequin, present standing).

- One-click open to the originating occasion or department path.

⚡ Fast Actions

Three playing cards to get shifting quick:

- Dashboard → metrics & map

- Occasion Explorer → occasions → branches → proof

- Commerce Setups → browse & audit outcomes

👉 Internet App: https://aletheia.giize.com

🔍 4 Instance Setups From v1

Beneath are 4 actual tickets from v1. Click on the path hyperlink to examine the total reasoning within the app.

🟢 CRWD (Crowdstrike Holdings Inc) – 📍 Entry: 450.62 | TP1: 430.40 ✅ TP2: 410.18 ✅

Catalyst: Palo Alto Networks is in talks to accumulate CyberArk in a deal valued at roughly $20 billion, probably reshaping the cybersecurity market.

Reasoning path: https://aletheia.giize.com/Event_Explorer?occasion=9594&department=26994

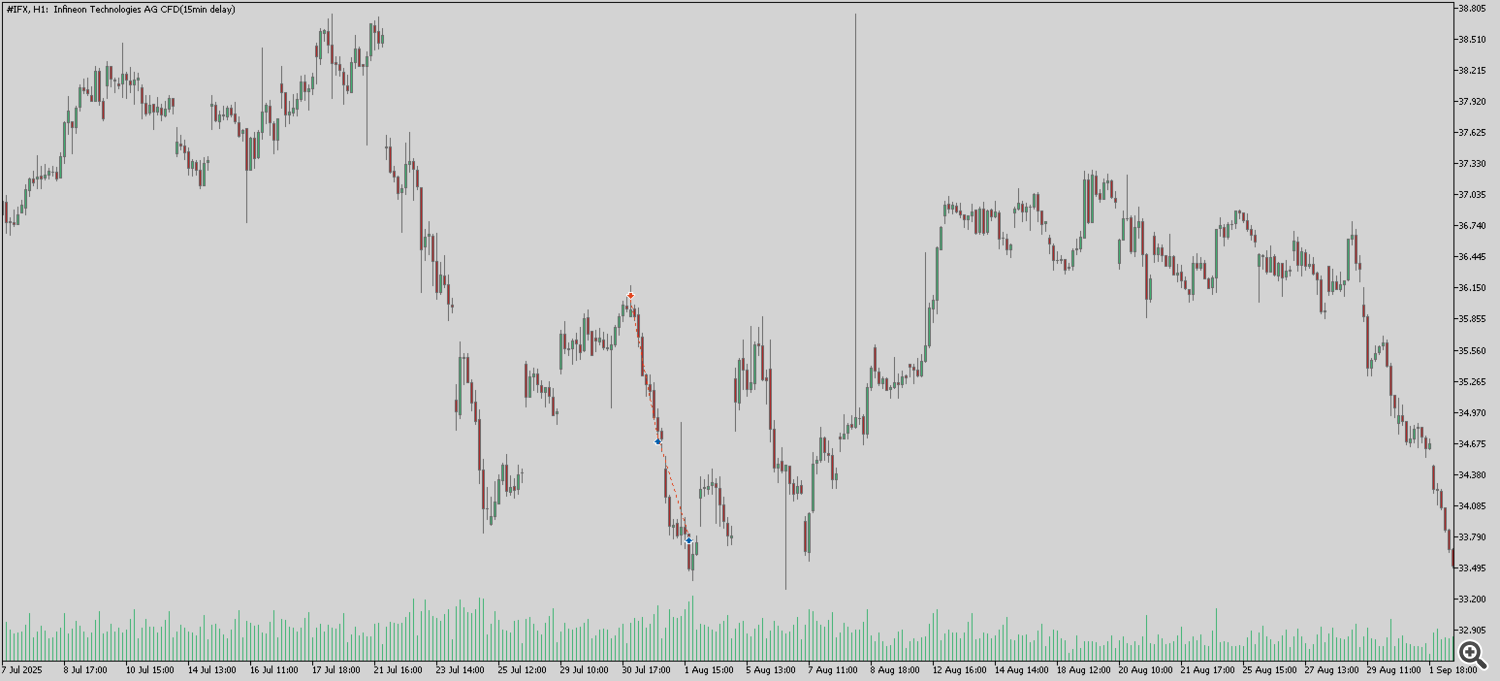

🟢 IFX (Infineon Applied sciences AG) – 📍 Entry: 35.949 | TP1: 34.823 ✅ TP2: 33.697 ✅

Catalyst: Intel cancels deliberate semiconductor fabrication tasks in Germany and Poland and consolidates testing and meeting operations in Vietnam and Malaysia.

Reasoning path: https://aletheia.giize.com/Event_Explorer?occasion=8483&department=24067

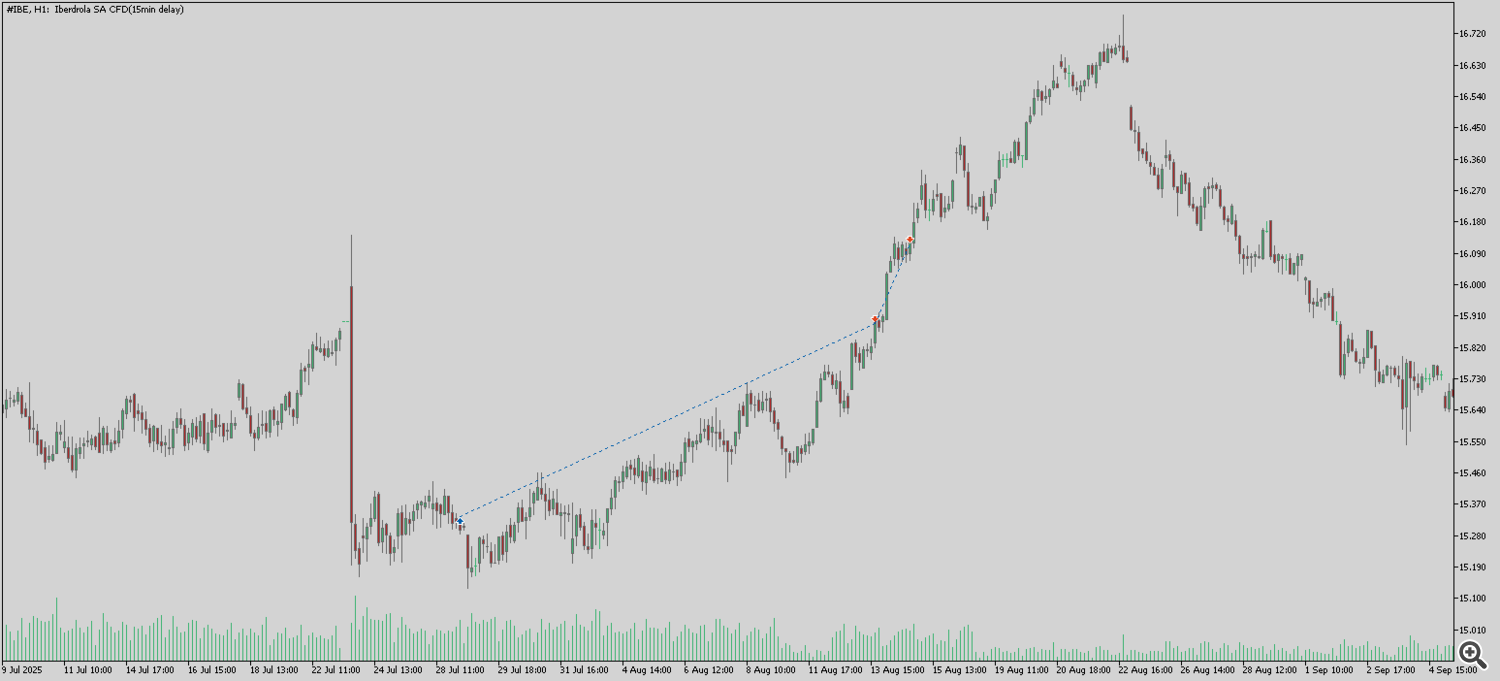

🟢 IBE (Iberdrola SA) – 📍 Entry: 15.32 | TP1: 15.69 ✅ TP2: 16.06 ✅

Catalyst: Authorities raises most worth paid to wind farm builders for electrical energy.

Reasoning path: https://aletheia.giize.com/Event_Explorer?occasion=8384&department=23805

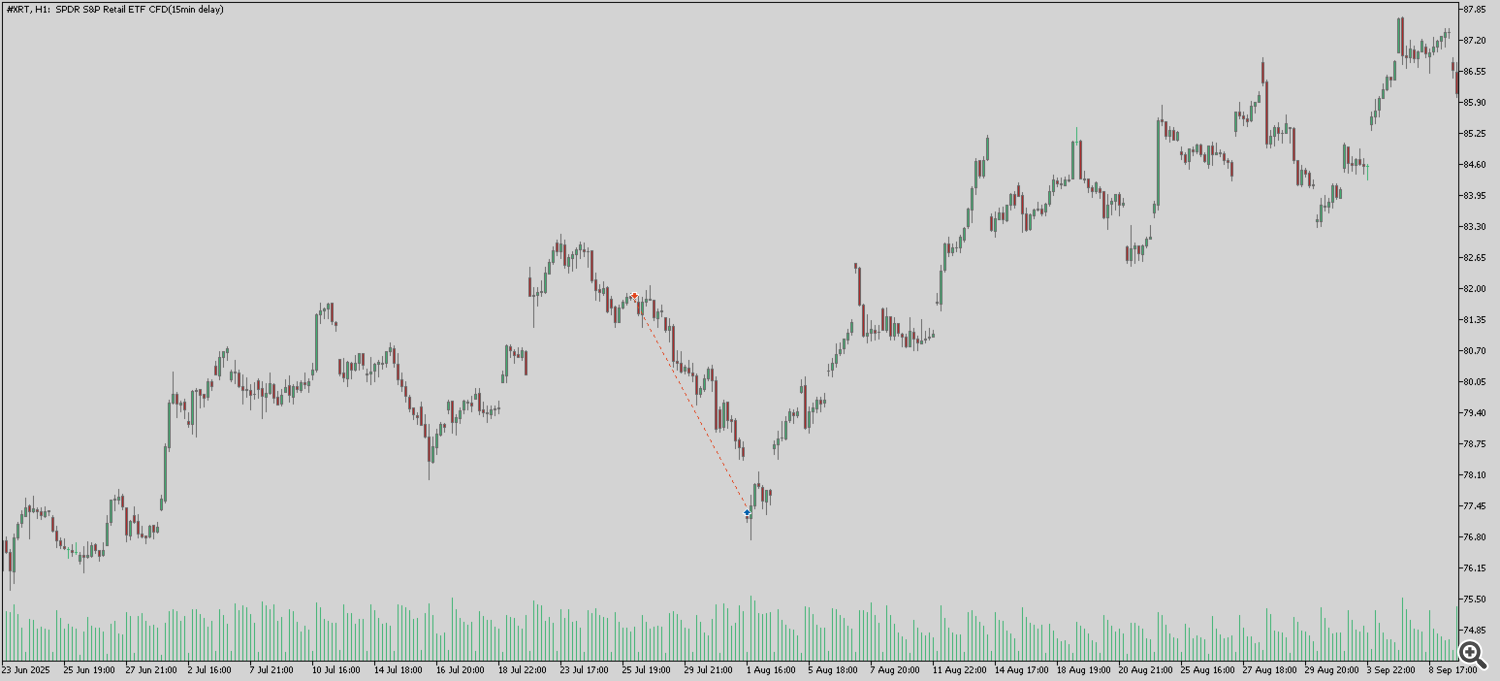

🟢 XRT (SPDR S&P Retail ETF) – 📍 Entry: 81.8 | TP1: 80.01 ✅ TP2: 78.22 ✅

Catalyst: U.S. corporations raised costs for items and companies in July, citing tariffs as a key issue contributing to inflationary pressures.

Reasoning path: https://aletheia.giize.com/Event_Explorer?occasion=8392&department=23833

🔄 What modified after pausing v1

-

New Reasoning Auditor (steady studying).

Scans the total reasoning path to validate that analyses are grounded in strong proof. Constantly up to date as extra setups and outcomes arrive.

Why it issues: filters out weak, oblique logic and favors direct, causal influence between occasion → asset. -

Proof gating tightened (carried ahead).

Stricter supply high quality & recency checks; patterns linked to v1 losses are down-weighted or blocked.

Why it issues: reduces speculative, large narratives slipping into setups. -

Websearch protection & parsing improved.

Broader area assist + higher parsers enhance profitable extractions and quotation depth.

Why it issues: extra (and cleaner) sources, fewer blind spots. -

Image Matcher upgraded.

Tighter ticker/venue mapping and battle decision to chop image mismatches.

Why it issues: improves asset concentrating on accuracy earlier than orders are fashioned. -

Targets & RR optimizer (from v1 historical past).

Re-tuned goal choice utilizing all historic setups: shorter entry→SL, longer entry→TP1/TP2 distances.

Why it issues: raises common anticipated R whereas controlling draw back. -

MT5 execution security (lot-step conscious).

Orders that have been too giant for dealer constraints are actually auto-split into smaller tickets so threat per setup stays actual.

Why it issues: constant place sizing → extra strong reside conduct. -

Partial-closure reliability repair.

Edge instances that didn’t set off TP1/TP2 partials have been corrected; state sync improved.

Why it issues: predictable profit-taking and cleaner P/L attribution. -

Setup QA move (carried ahead).

Validator rejects imprecise or duplicate theses; enforces readability earlier than something can turn into a commerce.

Why it issues: higher-quality setups, fewer noisy entries.

Anticipated v2 impact: Fewer however higher-conviction trades, tighter threat, clearer audit trails.

🚀 Check Part v2 — Beginning Now

I’m kicking off v2 with the up to date pipeline and the brand new internet app.

Be a part of v2: in case you’d wish to comply with alongside, overview setups, or stress-test reasoning, bounce in: