15 Sep Bitfinex Alpha | Bitcoin Rebounds as Stagflation Pressures Mount

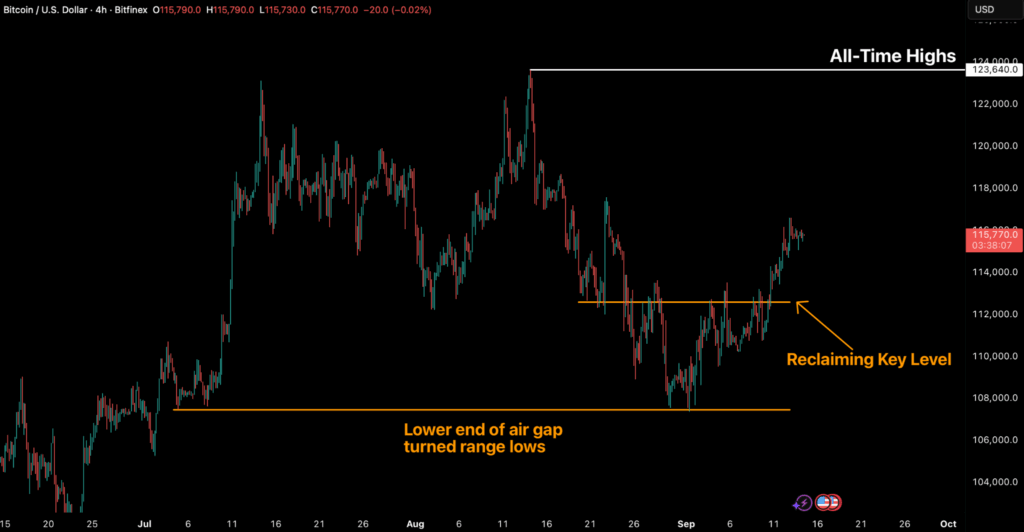

Bitcoin closed the week 4.2 % greater, breaking a three-week decline and reclaiming the crucial $112,500 assist stage after defending the $107,500 vary lows. This rebound from the decrease finish of the hole marks an essential structural restoration, setting the stage for stability into late September and probably stronger upside momentum in This autumn. On-chain information helps this backdrop: the cost-basis distribution heatmap highlights clear dip-buying round $108,000, whereas provide clusters between $110,000 and $116,000 now outline the short-term vary. A decisive transfer above $116,000 would verify renewed momentum; till then, consolidation stays the bottom case.

Cohort behaviour reveals that 3–6 month holders realised $189 million in every day earnings on common, accounting for almost 80 % of all short-term holder promoting in the course of the rebound. This profit-taking has acted as a near-term headwind, but total market construction stays constructive. Whole crypto market capitalisation rose 4.8 % this week to $3.97 trillion, reflecting a cautious however persistent accumulation bias. Whereas volatility persists, each BTC and the broader market seem like stabilising, with situations aligning for a restoration section as soon as resistance ranges are cleared.

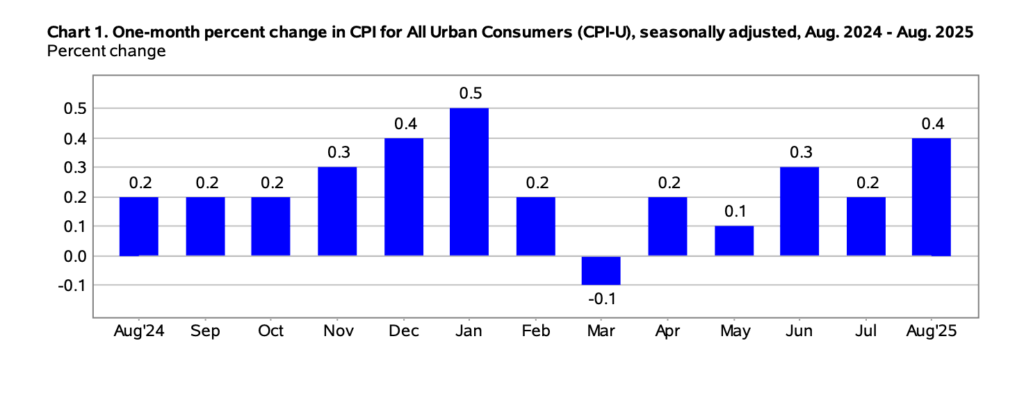

US financial situations are more and more outlined by a fragile stability between cussed inflation, weakening labour markets, and resilient—but fragile—client behaviour. August’s Client Value Index confirmed the sharpest improve since January, with broad-based beneficial properties in housing, meals, and vitality prices, a lot of it pushed by tariffs and provide disruptions. On the similar time, the labour market has softened significantly, with jobless claims climbing to their highest stage since 2021 and payroll revisions revealing that employment progress was overstated by almost one million jobs.

Shifting to the family stage, the identical tensions are taking part in out in sentiment and spending. Client confidence fell to its lowest studying since Could, reflecting considerations about inflation and job safety, whereas inflation expectations stay elevated. But regardless of this gloom, spending patterns reveal resilience, with credit score use increasing and households largely maintaining with their monetary obligations. Households are drawing on financial savings and credit score to keep up consumption, sustaining progress within the close to time period however elevating questions on sustainability if wage progress continues to lag. Collectively, these dynamics spotlight a fragile equilibrium: policymakers are caught between inflation management and employment assist, whereas households are stretching to protect buying energy.

In the meantime, the digital asset sector is seeing fast shifts throughout exchanges, regulators, and corporates. Within the US, Cboe plans to launch “Steady Futures” for Bitcoin and Ether this November, providing long-term publicity inside a regulated framework. Hong Kong, in the meantime, is proposing to ease capital guidelines for banks holding compliant digital belongings, aiming to draw establishments whereas retaining strict buffers for riskier tokens. On the company entrance, Cyprus-based Robin Power accomplished a $5 million Bitcoin allocation, briefly sending its top off greater than 90 %. Collectively, these strikes spotlight how crypto is turning into extra embedded in international finance, by regulated markets, evolving coverage, and company adoption.