Everybody likes to have enjoyable with hypothetical “Desert Island” questions. You understand those the place you’re sitting round with your pals asking one another what you’d take with you or maybe who you’d take with you in case you solely had ONE alternative and needed to be banished to an uninhabited / desert island for the remainder of your life?

Everybody likes to have enjoyable with hypothetical “Desert Island” questions. You understand those the place you’re sitting round with your pals asking one another what you’d take with you or maybe who you’d take with you in case you solely had ONE alternative and needed to be banished to an uninhabited / desert island for the remainder of your life?

In at present’s lesson, I needed to have a little bit of enjoyable but in addition talk about with you what I’d take with me if I may solely choose ONE buying and selling strategy for the remainder of my life. If I used to be going to a desert island (that had glorious web connection lol) these are the buying and selling instruments that I’d take with me…

Right here’s how I’d enter the market…

If I needed to solely search for ONE value motion sample to enter the market from, it will be a really apparent and highly effective one, one thing that when you perceive, is tough to overlook…

What I’d be searching for is a pin bar or tailed bar, ideally a long-tailed pin bar. These are patterns with an clearly lengthy tail (or shadow), it doesn’t should be a “pin bar” per say, though it’s higher whether it is, however a easy tailed bar situated correctly will work too.

Let’s take a look at some examples of what I’m searching for on a day-to-day foundation out there relating to tailed bars and pin bar reversals:

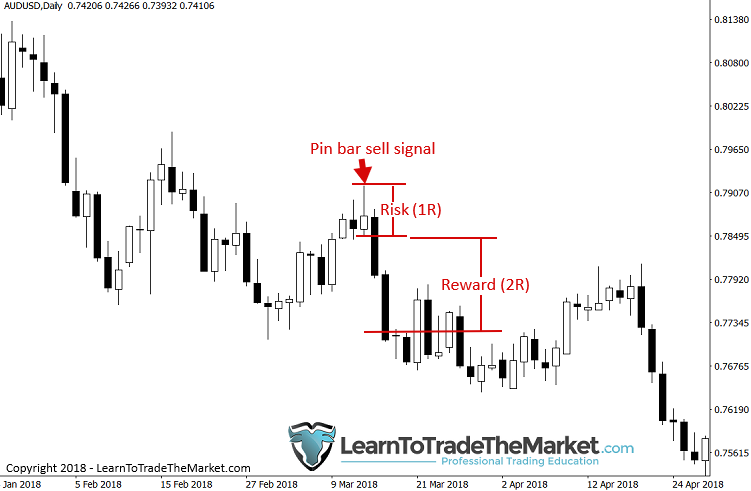

Right here’s an instance of a long-tailed pin bar (promote sign) inside a down-trending market:

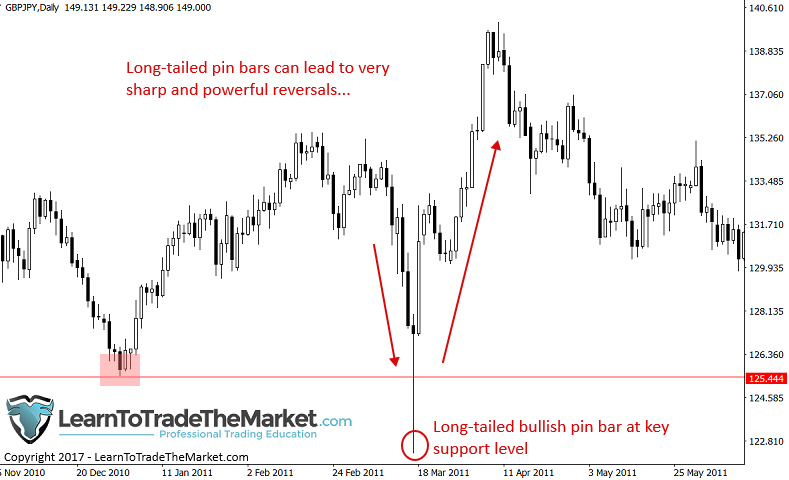

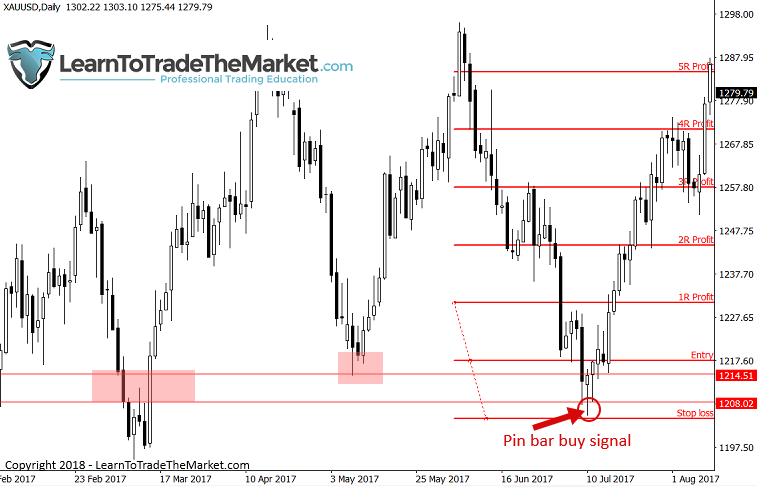

Right here’s one other instance of a long-tailed pin bar. This time, it’s a bullish long-tailed pin bar (purchase sign) that fashioned at a key help degree out there:

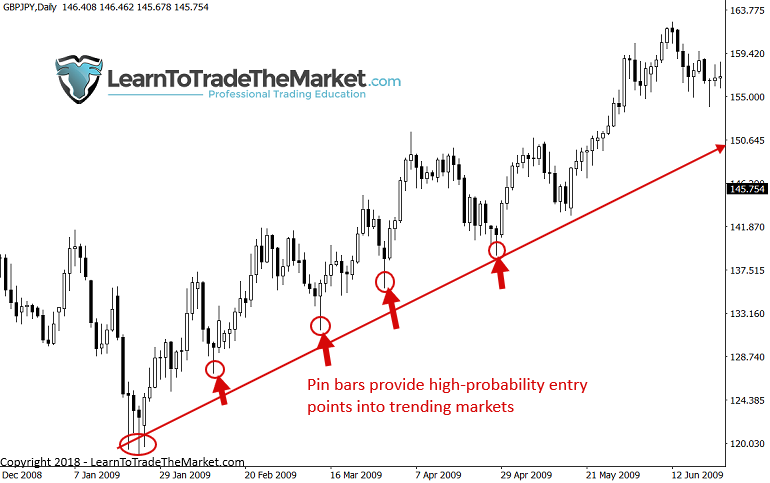

As we are able to see within the subsequent instance, pin bars usually give us very straightforward to identify entries into highly effective tendencies. The truth is, a pin bar after a pull again inside a pattern might be my favorite value motion entry setup:

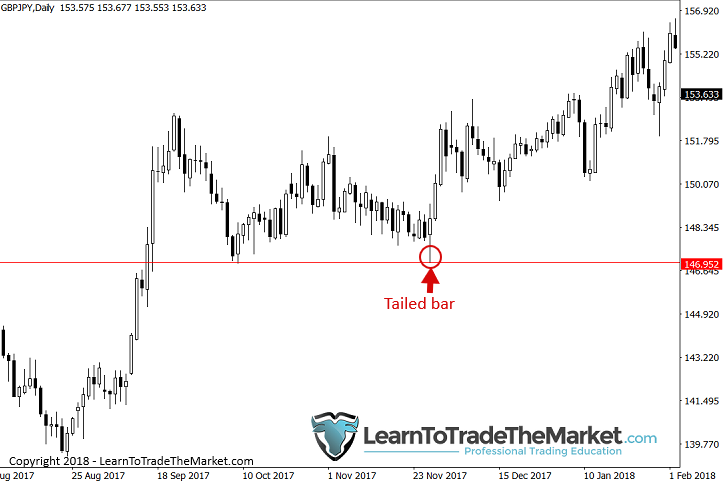

Subsequent, let’s try a tailed bar; a bar that isn’t fairly a “pin bar” however nonetheless primarily portrays and implies the identical factor. The primary distinction is the physique (distance between open and shut) of the bar will not be fairly as small as a pin bar’s in relation to the full size of the bar:

From the examples above, it needs to be obvious what I’d be searching for if I may ONLY choose ONE entry sign to make use of for the remainder of my life. It must also be obvious WHY I’d select pins / tailed bars; they convey a vital message about what’s prone to occur subsequent out there, in a really clear and highly effective means.

For a extra detailed tutorial on tailed bars, see my tailed bar buying and selling tutorial

For a extra detailed tutorial on pin bars, see my pin bar buying and selling tutorial

Cash administration

It’s at all times amusing to me that almost all starting merchants appear virtually solely involved with their commerce entries when in truth the extra necessary a part of buying and selling is cash administration. Cash is made or misplaced relying upon how nicely you handle your trades and your cash, not a lot on how nicely you enter the market (though entries do play an necessary function).

No commerce entry technique or buying and selling methodology could be full with no cash administration plan. An important features of cash administration for a dealer, are place sizing and threat reward. These are the cash administration elements I’d be frightened about for my “desert island” strategy.

After I discuss place sizing, I’m referring to the variety of tons (in Foreign exchange) or the commerce quantity / variety of contracts / shares (shares) and so on. We’re speaking concerning the SIZE of the place you might be buying and selling. Why is that this so necessary? Nicely, as a result of it determines how a lot cash you’ve in danger; the bigger place, the extra money you might be risking. The opposite cause it’s so necessary is as a result of correctly adjusting your place dimension to keep up your total 1R threat per commerce, is significant to long-term buying and selling success.

To learn extra about place sizing, try my lesson on place sizing.

Danger reward is the opposite vital cash administration element. This refers to discovering a commerce’s threat vs. its potential reward, which you sometimes need at 1 to 2 or extra (Reward at 2 instances threat). It’s necessary to think about the potential threat / reward of any commerce earlier than you enter it, as a result of whether or not a great threat / reward is attainable might affect your choice to take the commerce or not.

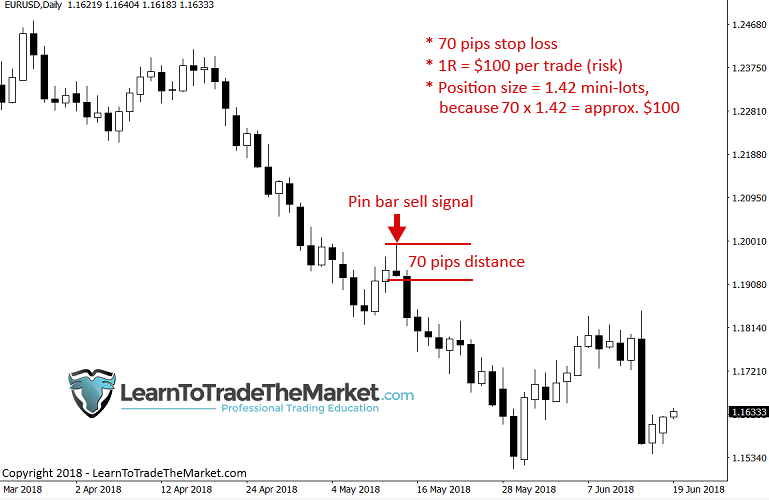

Discover within the instance beneath, the chance is 1R, the place R = the greenback quantity you’ve in danger on the commerce. On this case, the chance is the space from the entry (pin bar low) to the cease loss (close to pin excessive) and the reward is ready at 2R or 2 instances threat. It’s necessary to attempt to get reward of a minimum of double your threat so that you just make the most of winners once they come alongside and so they’re large enough to offset your losers and nonetheless provide you with a revenue.

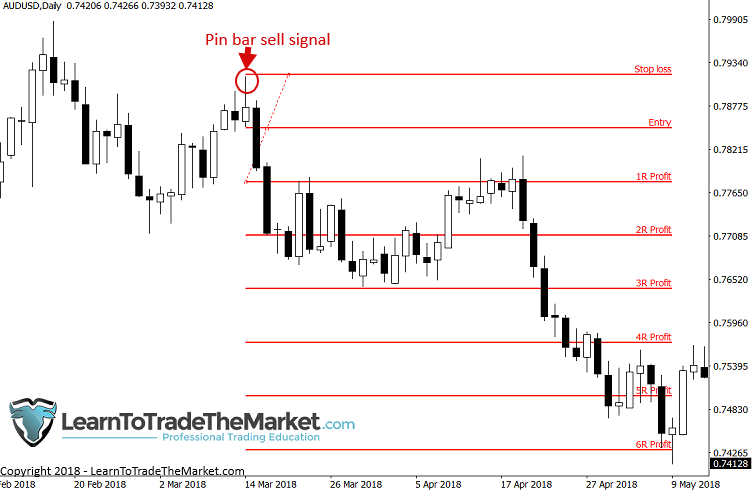

Within the instance beneath, we are able to see what it seems prefer to plot out the potential threat reward of a pin bar commerce. Discover I’ve personalized the MetaTrader 4 Fibonacci device to point out threat vs. reward of any commerce setup. I’ve detailed how to do that in an article on the threat reward device, so examine that out to study extra. Discover, this pin bar sign set off a possible 5R winner…

Every day time frames and low-frequency

A buying and selling technique wouldn’t be full with out one thing to carry it altogether, the X-factor, so to talk. For me, that’s buying and selling each day chart time frames in a low frequency buying and selling strategy.

Any such buying and selling primarily signifies that we’re targeted on the each day charts and we’re not trying to commerce usually, as a substitute, we’re searching for high-quality setups (which are usually considerably uncommon). What this does is will increase our potential win-rate per commerce and thus provides us a greater probability of making a living over the long-run. It additionally permits us to extra simply maintain our feelings in examine and largely eliminates the potential to over-trade, which is often the primary factor that kills merchants’ accounts.

Within the instance beneath, discover the pin bar entry alerts that fashioned at a key help degree, what I would like you to essentially discover is that this was the each day chart (as are all the opposite charts on this lesson and most of my classes). If I used to be stranded on a desert island, I may enter this commerce lengthy and let it set for 1-2 weeks and spend that point…attempting to construct shelter and collect meals…and are available again to an enormous revenue. Maybe a bit too hypothetical of an instance (what would you do with cash stranded on an island? Pay pirates to save lots of you possibly?!), however the level continues to be legitimate – Finish-of-Day buying and selling permits you to cut back your time dedication and helps to subdue / tame your emotional responses to the market so that you’ve got a greater probability at long-term buying and selling success, it’s a win-win!

If I used to be stranded on a desert island and will solely use one buying and selling strategy, it will be:

- Pin bars / tailed bars

- Cash administration

- Every day charts / end-of-day strategy

It actually is so simple as the three-point plan I outlined above, so cease over-complicating it.

To study extra about each day chart buying and selling and end-of-day buying and selling, try these tutorials:

Find out how to commerce ‘finish of day’ buying and selling methods

Every day chart time-frame buying and selling tutorial

Conclusion

Whereas at present’s lesson dealt in a hypothetical state of affairs of being pressured to select one buying and selling technique to take to a desert island for the remainder of your life, the knowledge and methods mentioned will not be hypothetical in any respect.

The methods I mentioned above are how I commerce 90% of the time in my day-to-day buying and selling. The ideas are transferable throughout all forms of markets, from Foreign exchange to futures, shares and wherever in between. They’re most relevant to the 1-hour time-frame and above, however as mentioned, I significantly want the each day chart time-frame to all others. So, regardless of the place you find yourself, on an island or a buying and selling desk, do not forget that the ideas mentioned right here and which are expanded upon in my superior value motion buying and selling course, have stood the take a look at of time and can serve you nicely in not simply surviving… however in thriving in all buying and selling environments.

What did you consider this lesson? Please share your suggestions within the feedback beneath!