We’ve got all seen GBP/USD struggling in current classes, sliding in direction of the 1.34 space.

On the floor, it appears to be like like a standard correction, however behind the candles there’s a deeper story.

Markets are usually not simply reacting to inflation information; they’re questioning the UK’s fiscal credibility. For us merchants, this issues as a result of the bond market and sterling are actually transferring hand in hand.

Macro Background: The Fiscal Facet of the Story

Current UK information confirmed producer costs choosing up once more (+1.9% YoY) whereas client inflation remains to be round 3.8%. Too excessive for the Financial institution of England to chop charges comfortably, however too delicate to justify additional aggressive hikes. In different phrases, financial coverage is caught within the center.

The actual stress, nonetheless, comes from public funds.

-

The UK now spends over £100 billion per yr simply on debt curiosity.

-

The ten-year gilt yield trades close to 4.9%, the best since 2008.

-

The 30-year yield has surged to 5.6–5.7%, ranges not seen for the reason that late Nineties.

Despite the fact that demand for gilts stays excessive (the final £14 billion public sale drew document orders above £140 billion), the fee is what issues. Each new issuance locks in larger curiosity bills, and that eats into the federal government’s fiscal area.

For merchants, this interprets right into a easy sign: confidence is shaky, and the pound tends to weaken when long-term yields rise for the “unsuitable” causes — not due to development, however due to fiscal doubts.

A Disaster of Confidence

The 2024/25 fiscal deficit reached £151.9 billion, properly above the £137 billion forecast. Revenues disenchanted, whereas spending on welfare, well being care, and debt servicing stored climbing. This widening hole feeds right into a notion downside: the UK authorities is seen as missing a reputable plan to stabilise debt dynamics.

Political uncertainty provides to the combo. The current reshuffle and appointment of Minouche Shafik as financial adviser weren’t seen as a present of energy however as a defensive transfer by Chancellor Rachel Reeves. Markets don’t like the thought of a weak Treasury when fiscal self-discipline is urgently wanted.

Because of this, buyers now demand the next time period premium — the additional yield required to carry long-dated gilts. That’s the reason yields are rising even with out new inflation shocks.

The Vicious Circle

The UK is caught in a suggestions loop:

-

Larger yields enhance the price of debt.

-

A wider deficit erodes investor belief.

-

Markets demand even larger yields.

This cycle appears to be like similar to the UK bond crises of the Nineties, however with one important distinction: as we speak, debt-to-GDP is greater than twice as excessive.

What Might Break the Cycle?

The market message is evident: marginal tax adjustments are usually not sufficient. To revive credibility, London should ship structural spending cuts, particularly in welfare and present expenditures. With out that, each gilts and sterling stay beneath stress.

The Financial institution of England additionally has restricted room. With steadiness sheet discount ongoing, its potential to clean long-end yields is constrained. That’s the reason the autumn Price range is the true take a look at. Merchants will watch carefully: both the federal government sends a powerful sign of fiscal self-discipline, or markets will hold promoting sterling rallies.

Chart View: GBP/USD with Weekly Pivots

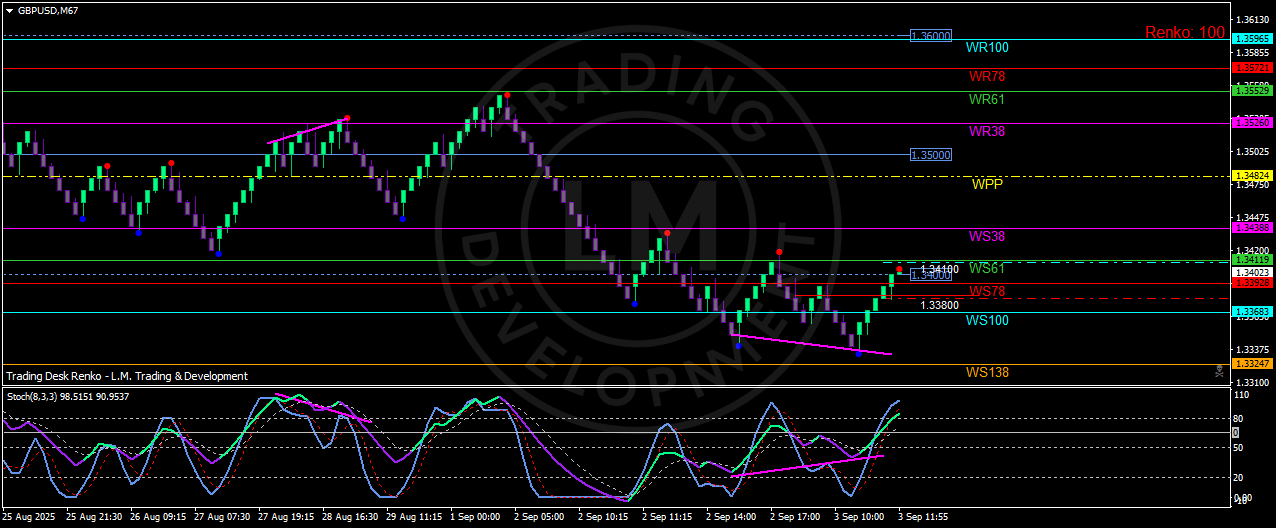

Now, let’s have a look at the chart facet. On a Renko GBP/USD M67 setup with weekly pivot ranges, the image is evident:

-

Resistance ranges:

-

1.3500 (psychological + WR38)

-

1.3525–1.3550 (WR61)

-

1.3595–1.3600 (WR100, prime vary)

-

-

Help ranges:

The Stochastic (8,3,3) is already deep in overbought (>90), suggesting the present bounce is shedding momentum.

Buying and selling Eventualities

-

Bearish bias: So long as GBP/USD trades beneath 1.3500, sellers stay in management. A rejection right here might push the pair again in direction of 1.3380 after which 1.3325.

-

Bullish state of affairs: Solely a decisive shut above 1.3525–1.3550 would unlock additional upside in direction of 1.3600. Till then, rallies are suspect.

-

Impartial setup: Between 1.3380 and 1.3500, the pair stays uneven. Merchants could choose to attend for a breakout affirmation earlier than committing.

Conclusion

The UK is dealing with fiscal stress that markets can now not ignore. Gilt yields are rising, not due to booming development, however as a result of buyers demand the next threat premium. That weighs instantly on sterling, and GBP/USD displays it clearly.

For us merchants, the important thing takeaway is straightforward: fundamentals and technicals are aligned. Macro doubts weaken the pound, whereas the chart exhibits robust resistance close to 1.35. Except London regains fiscal credibility quickly, each sterling rally could also be a chance to fade.

This evaluation displays a private view for instructional functions solely. It isn’t monetary recommendation