XRP closed Monday’s session below stress, reversing an earlier rally and ending close to the $3.00 threshold. A pointy selloff within the remaining buying and selling hour noticed the asset dip 1% on surging quantity, suggesting institutional distribution and stop-loss liquidations driving worth motion.

Technical Evaluation Reveals Blended Alerts

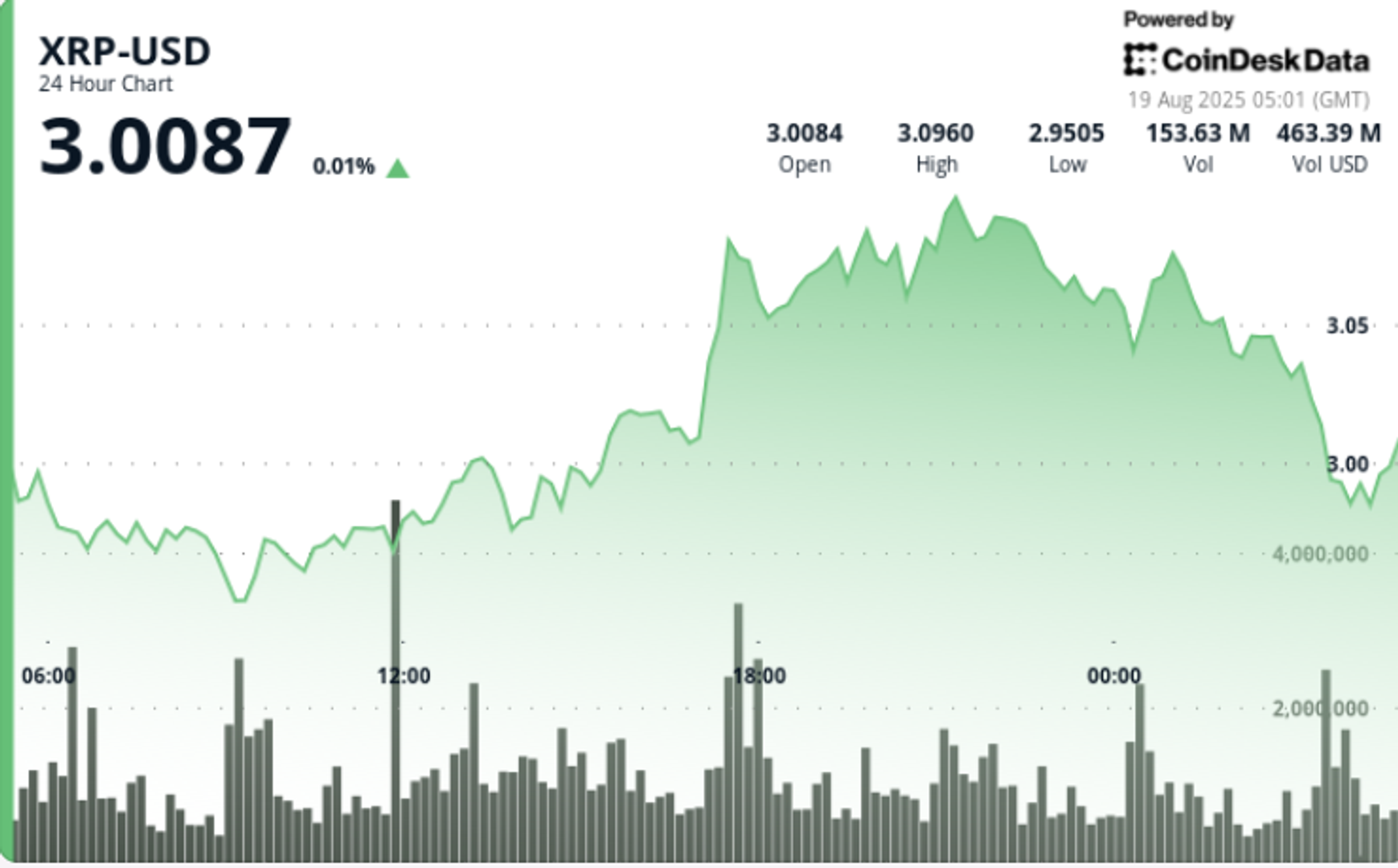

XRP traded inside a $0.11 vary between $2.94 and $3.10 throughout the 24-hour session from August 18 05:00 to August 19 04:00, representing almost 4% intraday volatility. A bullish breakout throughout the 17:00 buying and selling hour on August 18 pushed costs from $2.97 to $3.10, supported by heavy quantity of 131 million—double the 24-hour common of 66.8 million. This established short-term assist close to $3.00.

Momentum light shortly, nonetheless. The token rejected a number of instances at $3.09, sliding into consolidation round $2.99. An aggressive pullback unfolded throughout the 03:00 hour on August 19, when XRP dropped from $3.04 to $2.99.

Key Market Actions

• XRP declined 1% within the remaining 60 minutes, sliding from $3.03 to $2.99 as volumes spiked to five.26 million—5 instances the hourly common

• Distribution stress accelerated across the $3.00 psychological threshold, triggering stop-loss liquidations throughout the 03:43–03:46 interval

• A bullish surge earlier within the session (August 18 17:00) lifted XRP from $2.97 to $3.10 on 131 million quantity, far above common exercise

Market Dynamics Drive Sharp Reversal

The late-session breakdown confirmed institutional promoting close to $3.00, erasing the sooner breakout’s momentum. Whereas $2.99 supplied intraday stabilization, the volume-backed rejection at $3.09 highlights rising resistance stress.

XRP now sits at a crossroads: holding above $2.99 might permit bulls to retest the $3.08–$3.09 cluster, whereas failure dangers a deeper correction towards the $2.96 demand zone.

Technical Indicators Abstract

• Vary: $0.11 (3.8%) between $3.10 peak and $2.94 trough

• Resistance: $3.09, rejected repeatedly by night periods

• Help: $3.00 psychological degree, examined below high-volume distribution

• Threat: Breakdown towards $2.96 demand zone if $2.99 fails

• Sign: Bullish triangle construction intact, however momentum fading below profit-taking