What’s Leverage and Margin? (MT5 Step-by-Step + Tiny Instance)

Abstract

Leverage enables you to management a big place with a small deposit.

Margin is that deposit — the cash your dealer units apart to maintain your commerce open.

In MT5, figuring out your leverage and margin helps you handle danger and keep away from margin calls.

Key Takeaways

Larger leverage = greater trades, but additionally greater danger.

Margin is the cash locked by your dealer whenever you open a commerce.

In case your losses get too massive, a margin name can shut your trades.

MT5 reveals your margin and free margin reside within the Terminal window.

A – The Thought in Easy Phrases

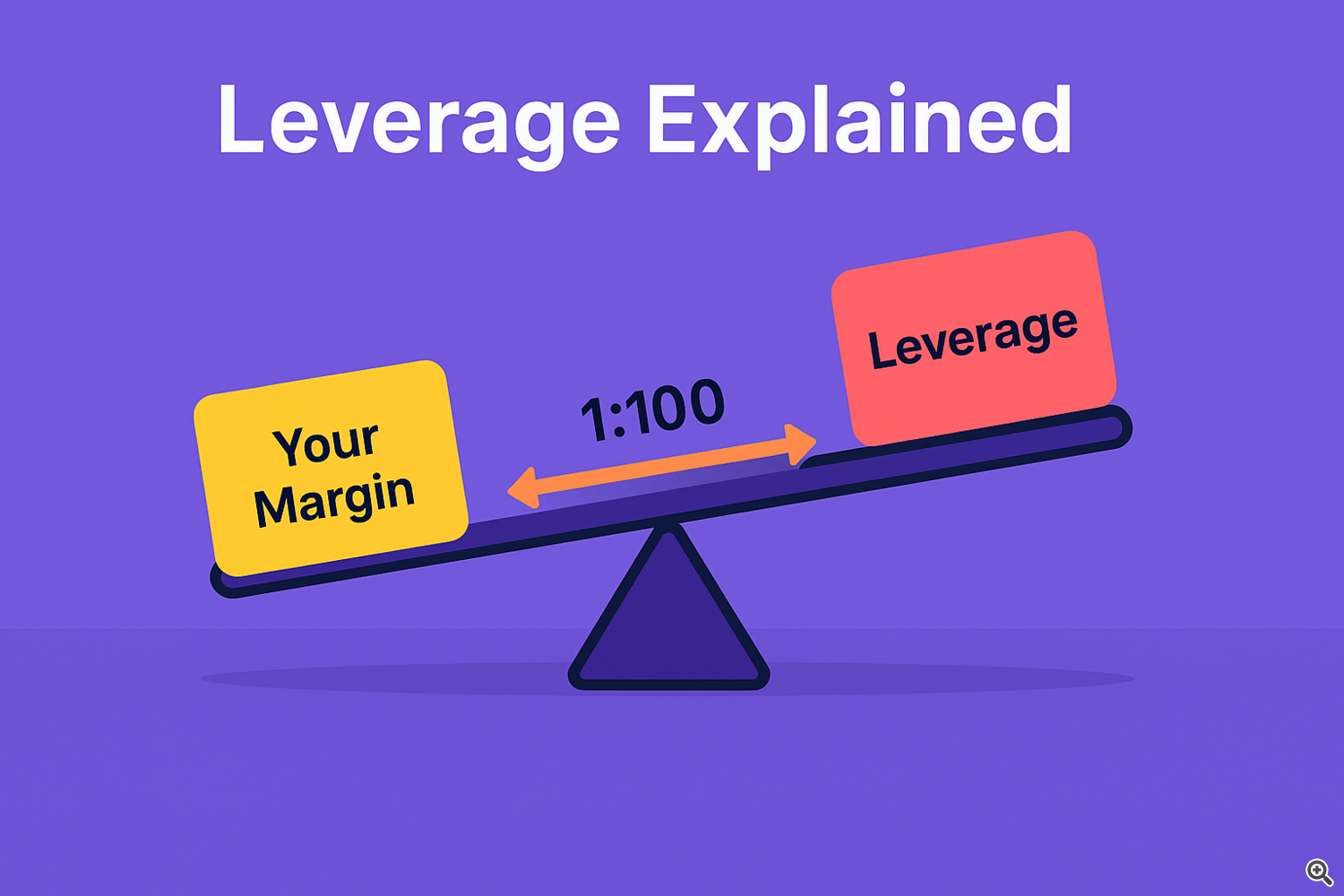

Leverage is sort of a mortgage out of your dealer that permits you to commerce greater than you will have.

In case you have $100 and leverage 1:100, you’ll be able to management $10,000 out there.

Margin is the a part of your cash that’s locked as a assure for that commerce.

The remainder of your stability is named free margin — cash you’ll be able to nonetheless use for brand spanking new trades or to soak up losses.

An excessive amount of leverage can wipe out your account rapidly if the market strikes towards you.

B – MT5 Steps to Test Leverage and Margin

-

Open MT5 and log in to your account.

-

Go to the Terminal window (Ctrl+T).

-

Click on the Commerce tab.

-

Search for:

-

Steadiness (complete funds)

-

Fairness (Steadiness ± open commerce earnings/losses)

-

Margin (cash locked for open trades)

-

Free Margin (Fairness – Margin)

-

Margin Stage (% = Fairness ÷ Margin × 100)

-

Your account leverage is ready by your dealer — you’ll be able to test it in your account particulars.

C – Fast Instance with Numbers

You have got:

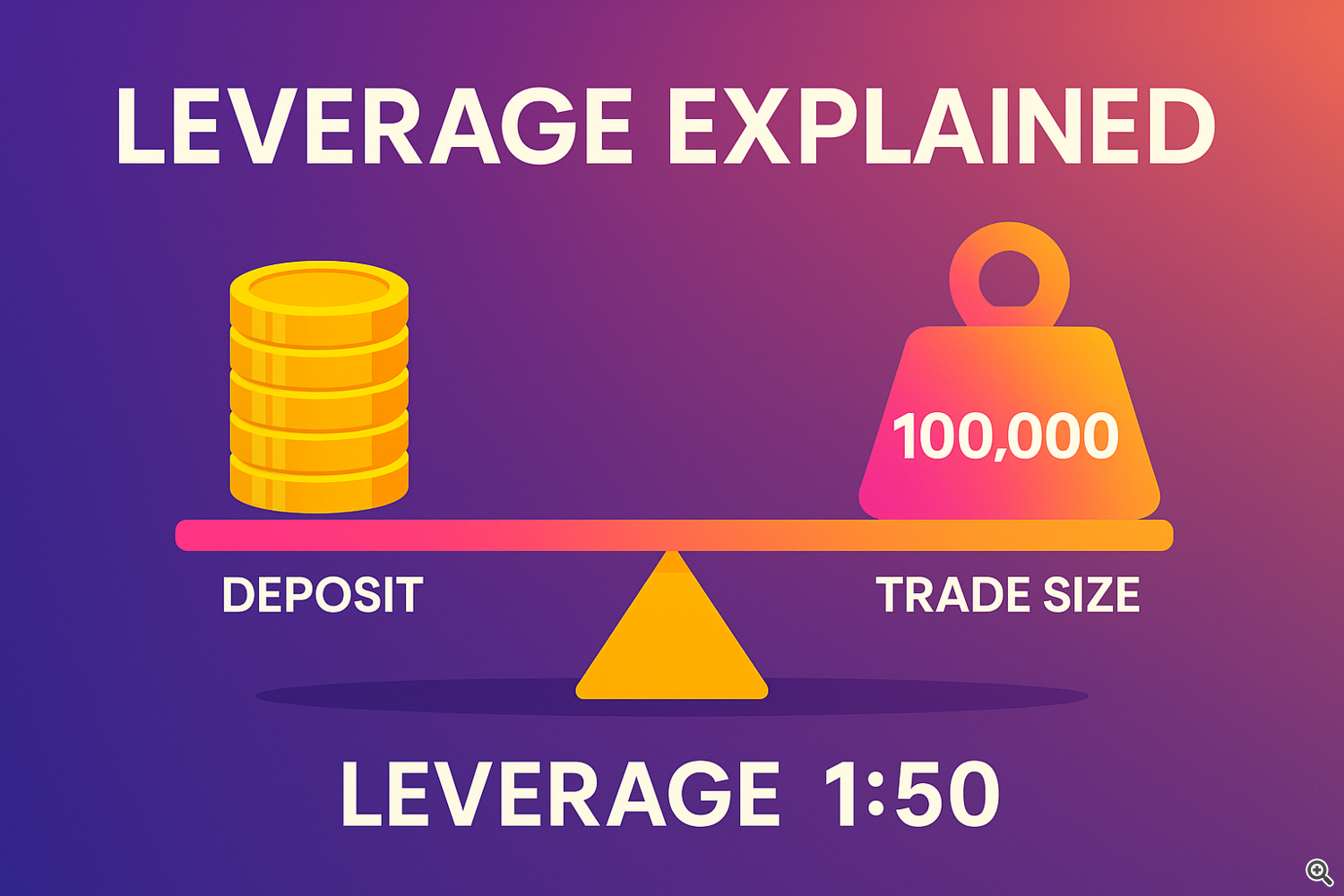

Required Margin = 100,000 ÷ 100 = 1,000 EUR (~$1,000 USD)

|

Time period |

Worth |

|

Steadiness |

$1,000 |

|

Place Measurement |

$100,000 |

|

Leverage |

1:100 |

|

Margin |

$1,000 |

Right here, your whole stability is used as margin — no free margin left for extra trades.

D – Frequent Errors & Fixes

-

Utilizing an excessive amount of leverage → Use smaller lot sizes to scale back danger.

-

Not checking free margin → All the time preserve some free margin to deal with losses.

-

Complicated margin with charges → Margin shouldn’t be a price; it’s a locked deposit.

-

Ignoring margin degree % → If it drops too low, you danger a margin name.

-

Buying and selling a number of pairs with out monitoring margin → Can rapidly over-leverage you.

E – If You Use My Instruments (Non-obligatory)

A few of my MT5 indicators show margin degree, free margin, and danger per commerce immediately in your chart.

Mini-Glossary

-

Leverage: A ratio exhibiting how a lot bigger your trades are in comparison with your capital.

-

Margin: Cash put aside by your dealer whenever you open a commerce.

-

Free Margin: Fairness minus margin — cash nonetheless out there for buying and selling.

-

Margin Stage: Fairness ÷ Margin × 100.

-

Fairness: Your stability plus or minus open commerce outcomes.

-

Steadiness: Complete cash in your account (no open trades).

-

Margin Name: Dealer motion when your margin degree is simply too low.

Guidelines

-

Know your account leverage.

-

Test margin earlier than opening trades.

-

Hold free margin out there.

-

Watch margin degree % to keep away from margin calls.

-

Use smaller positions if danger feels too excessive.

Observe the trades & updates on MQL5 → https://www.mql5.com/en/channels/issam_kassas