Did you ever see these Magic Eye posters that have been fashionable within the 90’s that had a hidden picture throughout the image and also you needed to regulate your eyes good and stand a sure distance away from the image to see the picture?

Did you ever see these Magic Eye posters that have been fashionable within the 90’s that had a hidden picture throughout the image and also you needed to regulate your eyes good and stand a sure distance away from the image to see the picture?

I personally bear in mind loving these as a child and I actually don’t know what occurred to them, however after I first began pondering of at this time’s lesson these footage got here to my thoughts. That’s as a result of similar to these footage, the market comprises a “hidden” message that solely these skilled within the artwork and talent of value motion buying and selling will be capable of see correctly. To the common particular person a value chart, they are going to see a bunch of seemingly random bars that imply nothing, however the value motion dealer sees the message that the footprint of cash (value motion) on the charts is telling them.

On this lesson, we’re going to talk about tips on how to begin seeing the hidden messages out there and what they imply.

Listening to The Market and Listening to What It’s ‘Saying’

With the intention to hear what the market is attempting to let you know, you have to first know precisely what to pay attention for. What you’re listening for are value motion clues, left behind because the “story” of the market performs out throughout a chart. And similar to studying a guide, to ensure that the present “web page” to make sense, you need to know what occurred earlier than, so meaning you need to know tips on how to analyze the previous value motion to make sense of the present value motion and use that to make an informed prediction about what MIGHT occur subsequent.

You see, any single bar, by itself, actually means nothing. It’s the bar COMBINED with the encircling market construction or context that paints the image of that marketplace for you. When you begin following a market lengthy sufficient you’ll start to realize it intimately and begin to get a intestine really feel for it, this comes with time, however it’s actually what “listening to the market” is all about.

Now, HOW EXACTLY do you hearken to the market and “HEAR” what it’s attempting to let you know? You do that by way of value motion evaluation and I’m going to provide you some particular examples of this under…

The charts are the market’s method of “talking” to us, however when you don’t know what to pay attention for, the message will go proper over you head. Let’s check out a number of the essential items of the value motion language of the market…

Latest Worth Habits and Market Situations

The primary main message it’s essential be taught to listen to on the charts is whether or not or not the market is trending. Whether it is trending, that’s very, superb for you as a result of development buying and selling is totally the best strategy to earn a living within the markets. If it’s not trending then it’s most likely consolidating both in a big buying and selling vary (which might be good to commerce) or a really small and extra random buying and selling vary (uneven and never good to commerce often). This is a crucial factor to be taught to decipher early-on as a result of it actually dictates which path you’re seeking to commerce and what you’re total strategy ought to be to that market in that situation.

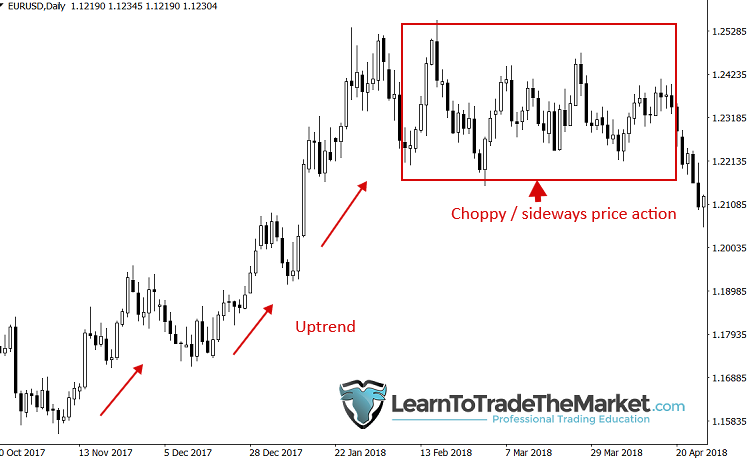

Discover within the chart under that value moved from a interval of uneven / sideways (small vary) value motion to a robust breakout, then a pull again to the buying and selling vary midpoint, earlier than an uptrend took maintain and carried value greater for months…

On this picture, value was trending greater aggressively earlier than pausing and getting into a protracted interval of sideways value motion. Clearly, the trending durations have been a lot simpler to commerce and extra fruitful. But, many merchants proceed to commerce (and lose their cash) as a result of they don’t know tips on how to interpret the language of value motion correctly, which was clearly telling them the market was getting into a interval of harder to commerce PA.

Key Ranges and “Good” vs. “Imperfect” Technical Evaluation

Maybe the following most essential “message”the market can ship you is HOW value is reacting / behaving round key chart ranges. Generally, a market will respect close by ranges very, very effectively (nearly precise and even precise in lots of circumstances). Generally, not a lot. I favor to commerce markets which might be respecting key ranges as a result of that tells me that for no matter purpose, this may proceed within the close to future. When you establish these ranges you’ll be able to then watch for high-probability value motion indicators to type at them. Nonetheless, if value will not be respecting ranges very effectively, it’s possible you’ll wish to keep away from that marketplace for now.

How value reacts round apparent key ranges is extraordinarily essential; are we technically ‘excellent’ for the time being or are the technicals messier and imperfect?

False-Breaks of Key Ranges and Contrarian Alerts

Human nature and are mind wiring makes most individuals actually, actually unhealthy merchants. It’s as a result of once we have a look at a chart and we see it going up, we FEEL prefer it’s going to maintain going up, however that is often concerning the time it’s going to go down once more, lol. It may be very, very irritating to the newbie or to the dealer who doesn’t but perceive tips on how to pay attention and HEAR what the value motion is telling them. As soon as factor I’ve written about extensively each on my weblog and in my buying and selling programs, is how you need to commerce like a contrarian to revenue out there. There are value motion clues that tip us off to when a contrarian transfer is underway and value is about to go again the wrong way. Certainly one of them is a false break of a degree and naturally there’s the fakey buying and selling technique as effectively. These are a few of my favourite patterns to commerce as a result of it exhibits the underlying market psychology and is a strong clue as to what may occurs subsequent.

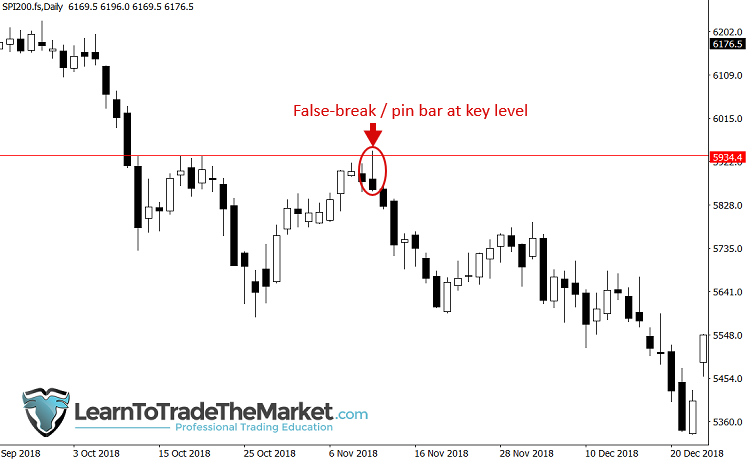

Notice, within the chart under value made a false-break of resistance earlier than reversing decrease once more in aggressive style.

Failed Worth Motion Alerts Are Superior. Wait, What?

Ah, the failed value motion sign, sure they are often painful and certainly typically a commerce merely doesn’t work out, that’s a truth of buying and selling you need to take care of by way of correct threat administration. BUT, (you knew a however was coming) typically failed value motion indicators might be very highly effective indicators themselves. For instance, when you see value violate the excessive or low of a specific sign that you simply thought was going to have the alternative consequence, ask your self what’s that telling you? What’s the MARKET TRYING TO TELL YOU???

Don’t over-think it. For those who see a value motion sign fail, that could be a robust clue that value could preserve shifting in that very same path…

Occasion Areas and Latest Worthwhile Worth Motion Alerts

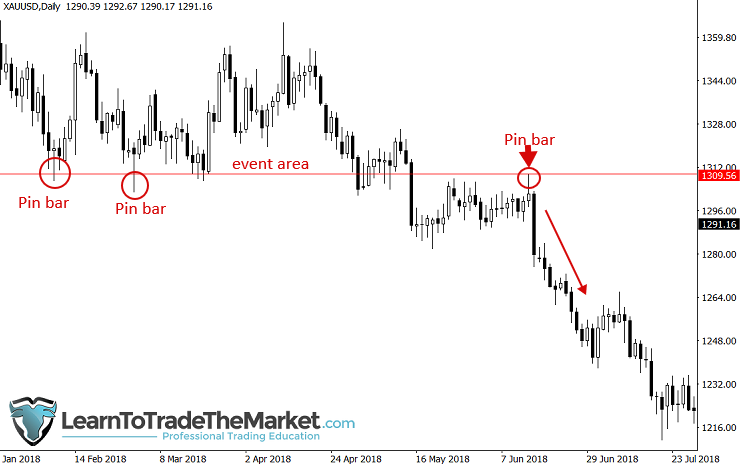

For those who don’t know what are occasion areas, I recommend you learn my lesson on the subject, as a result of they’re crucial message areas that the market needs you to look at. Whenever you see a number of value motion indicators that labored out coming from the identical or comparable space, you’ll have an occasion space, and when you see one other sign at that space, it’s a really robust sign to contemplate.

Discover the pin bars this degree, when the final one on the fitting fashioned you missed out on a massively worthwhile transfer when you didn’t know tips on how to interpret the message the market was supplying you with…

I Want You to Assume Past the Precise Act of Buying and selling

Technical Evaluation is a language and we have to interpret that language if we wish to have an opportunity at long-term, on-going buying and selling success.

Like most rich enterprise individuals will let you know; loads of listening, hear what others should say and collect suggestions, then decide. It’s usually stated ‘”Be the final man within the room to talk”; a cliche enterprise phrase from most enterprise management books, however it occurs to be true. Translated into the buying and selling world, we are able to ‘pay attention’ to the markets message after which let the market present us what it needs to do, then we use that gathered suggestions to type our opinion, make a plan after which act accordingly.

Nonetheless, it’s extra than simply “listening to the message”, you need to mix the messages the market is sending you (see above examples) and formulate these messages into the ‘story’ being advised on the chart from left to proper. You wish to paint a visible “map” by annotating the technical elements in your charts similar to I do in my weekly market commentary.

We use the message to each take trades AND to keep away from trades and to develop a normal really feel of market situations, very similar to studying the climate and forming forecasts. You’re not performing on each forecast you make however a few of them may show very helpful for planning what you’ll do subsequent.

In that vein, you wish to act on the clearest messages and act on the strongest market forecasts solely, the messages we interpret should not merely what I might usually train as confluence of things. The idea of “listening to the market’s messages” actually is one thing higher than simply recognizing a commerce setup. We’re speaking about listening to the message the market is telling us concerning the good cash, with that data we are able to decipher many many issues, we’re going far past the concept of “hey I can see 1 + 2 issues, so now I have to take motion.” When you attain a sure level in your value motion mastery, you’ll being to really feel just like the market is definitely “talking to you” and telling you what to do somewhat than you attempting to inform it what to do (which by no means works fyi).

Conclusion

My buying and selling strategy relies round watching charts each day and decoding the messages being broadcast from the market. We should be there to pay attention for it, map it and interpret it. Consider it as studying a web page in a guide day by day. Within the buying and selling world, meaning on the New York shut day by day Monday to Friday, I’m there listening to the message being broadcast (i.e. studying the value motion, mapping the charts and deciphering its hidden message). Nonetheless, that doesn’t imply that I’m sitting there ALL day staring on the charts. I’ve my deliberate occasions to test the markets every day and if I’m not “listening to” something from the charts that day then I neglect about them till tomorrow. I don’t sit there attempting in useless to “pressure” one thing that isn’t there

9 occasions out of ten I don’t take motion, however that one day trip of ten that I do take motion I’m pulling the “set off” on the commerce like a lethal sniper ready to take the “kill shot” as soon as the correct commerce setup is in focus. If you wish to be taught extra about listening to what the market is saying and studying to interpret it successfully, try my skilled buying and selling course for extra data.

Please Go away A Remark Under With Your Ideas On This Lesson…

If You Have Any Questions, Please Contact Me Right here.