Ever want your buying and selling might be extra constant, however in some way, your outcomes don’t reside as much as expectations?

Regardless of following a method, sticking to your setups, and doing every little thing “proper”…

…you’re left questioning why the progress simply isn’t there.

Or worse but, perhaps you’ve had an ideal run, solely to look at it vanish after a string of losses!

Sound acquainted?

The reality is, it’s not all the time concerning the trades themselves.

Generally, it’s extra about the best way you interpret the mathematics, how one can suppose in possibilities, and the psychology behind buying and selling.

Understanding that’s precisely what this text is about!

Whereas most merchants deal with setups, entries, and indicators, few take the time to grasp the deeper forces that actually drive long-term profitability.

When you don’t know how one can suppose in possibilities… or how one can lose ten trades in a row whereas nonetheless be doing every little thing proper… Then it’s solely a matter of time earlier than your confidence begins to crack.

On this article, I’ll cowl the important thing ideas each dealer must know to commerce with confidence, particularly when issues don’t go your method within the quick time period.

Right here’s what we’ll discover collectively:

- What possibilities are, how they work, and why they drive every little thing in buying and selling

- The idea of expectancy and how one can be worthwhile even with a low win charge

- Why dropping streaks are regular, and how one can calculate the chances of them taking place

- The reality about randomness, end result bias, and how one can keep targeted on course of over outcomes

- The right way to shift your considering from particular person trades to commerce sequences

- Why figuring out your numbers offers you the arrogance to climate drawdowns and keep constant

Whether or not you’re new to buying and selling or seeking to tighten up your edge, understanding these ideas will fully change the best way you method the market.

Sound good?

Let’s dive in!

The right way to Suppose in Chances: How Does Chance Work?

Okay, so let’s begin with what possibilities are.

Take into consideration whenever you place a commerce. You’re making a choice which is, by nature, unsure.

Regardless of how good the setup appears to be like, there’s all the time an opportunity it gained’t work out.

The particular particulars are what chance can educate you.

It helps you make sense of the uncertainty and construction your considering so you may keep grounded in logic as an alternative of feelings.

Let me clarify.

At its core, chance is a option to measure the probability of one thing taking place.

It ranges from 0 to 1, with 0 which means “by no means” and 1 which means “all the time.”

If one thing has a chance of 0.5, or 50%, it means it ought to occur about half the time over a lot of makes an attempt.

You’ve seemingly already met chance, with out even realizing it.

The most typical instance to consider is flipping a coin.

There are solely two outcomes — heads or tails — and each are equally seemingly.

The chance of getting heads is 1 out of two, or 50%.

Easy sufficient, proper?

However issues get extra fascinating when chance is utilized to real-world choices, particularly in buying and selling.

How does it work in observe?

Let’s say you’ve acquired a method that, based mostly in your backtesting or buying and selling journal, wins 60% of the time.

That doesn’t imply each 10 trades offers you precisely 6 winners and 4 losers, although.

What it means is that over time, as you’re taking extra trades, that 60% win charge will reveal itself.

However not essentially within the quick time period.

In reality, randomness can create streaks that make it really feel like your technique isn’t working in any respect, even when it’s!

That’s the place understanding chance could be a game-changer.

It helps you keep calm and assured when your short-term outcomes don’t mirror the long-term edge you recognize you might have.

You Already Use It Each Day

Even exterior of buying and selling, chance is constructed into the best way you make common choices.

Take a climate app for example, when it says there’s a 70% likelihood of rain, you may take an umbrella simply in case.

70% doesn’t imply it will rain, nevertheless it’s extra seemingly than not.

And guess what, when it doesn’t rain, you don’t delete the app, proper?

You perceive that the forecast simply didn’t work out this time.

It’s the identical with buying and selling.

Simply because a setup fails doesn’t imply it was a foul commerce.

It might have been a high-probability setup that merely didn’t work this time.

That’s the character of chance.

It performs out over a big pattern measurement, not in single occasions.

Why It Issues

When you deal with your trades as possibilities quite than certainties, every little thing adjustments.

You cease obsessing over particular person outcomes and begin considering when it comes to long-term outcomes.

That shift in mindset offers you the emotional resilience to deal with drawdowns, persist with your plan, and belief your edge.

It additionally helps you handle your danger correctly.

You’ll know to not danger an excessive amount of on anybody commerce as a result of even high-probability trades can lose.

As a substitute, you begin considering when it comes to anticipated outcomes, not assured ones.

When you embrace chance as a instrument quite than a guess, you cease seeing the market as a puzzle you need to resolve and begin seeing it as a sport of technique, the place the chances don’t have to be good to win…

…simply tilted barely in your favor over time.

This must be thrilling information as a result of the extra you dive into this, the extra you’ll perceive that YOU are doubtlessly what’s getting in the best way of your buying and selling system, quite than there being one thing improper with it!

Let’s increase on the thought.

The right way to Suppose in Chances: What’s Expectancy and Why Does It Matter?

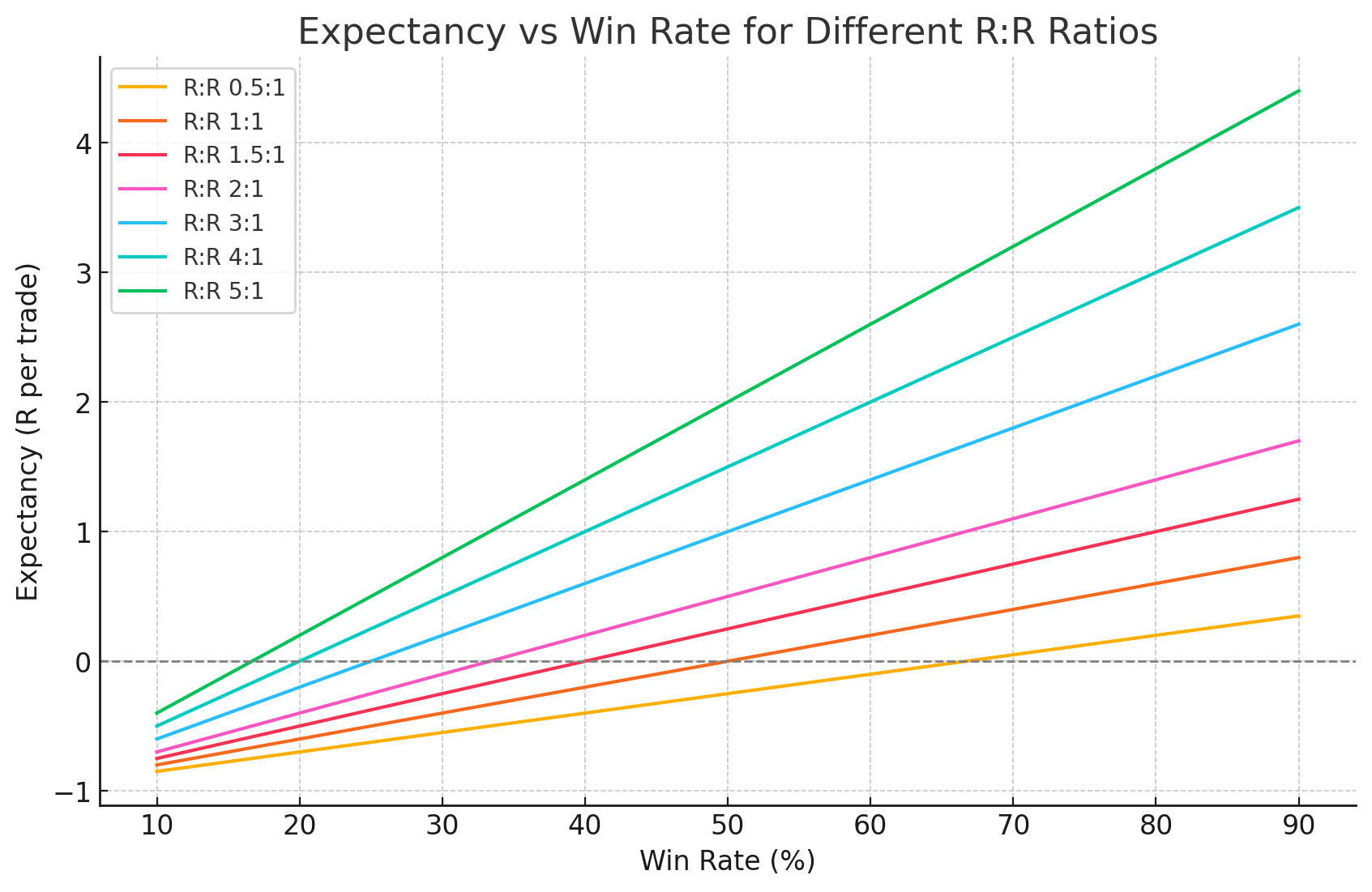

You’ve most likely heard folks discuss win charges, risk-to-reward ratios, and consistency, however should you actually wish to perceive whether or not your technique works, you must perceive expectancy.

Expectancy is the quantity that brings all these stats collectively and tells you what you may realistically count on to make (or lose) per commerce in the long term.

Let’s discover additional.

Expectancy Outlined

Expectancy is the typical quantity you may count on to win or lose on every commerce.

It combines your win charge and your common reward-to-risk ratio into one components.

Which may sound sophisticated, however when you see it in motion, it turns into easy and extremely helpful.

Right here’s the components, write this down someplace for now:

(Successful % × Common Win) – (Dropping % × Common Loss) = Expectancy

With that in thoughts, let’s break that down with some actual examples so you may see the way it works.

Instance 1: A excessive win charge with small income

Let’s say you win 70% of your trades, and on every successful commerce, you make $100.

Your losses, although, are $200 every.

Even with a excessive win charge, this technique may not be worthwhile.

Let’s have a look.

Expectancy = (0.7 × 100) – (0.3 × 200)

= 70 – 60 = $10

Okay, so on common, you’d make $10 per commerce.

It’s nonetheless constructive, however not by a lot, and if that win charge dips even barely, you possibly can find yourself dropping cash general.

Are you able to see how this supposedly excessive win charge doesn’t name for a lot celebration?

Its usefulness turns into a lot clearer with a greater thought of expectancy.

Let’s check out one other instance.

Instance 2: A decrease win charge with greater rewards

Now let’s flip it.

Think about you solely win 40% of the time, however every win offers you $300, whereas losses are capped at $100.

Expectancy = (0.4 × 300) – (0.6 × 100)

= 120 – 60 = $60

Though you lose extra usually than you win, your expectancy is far increased, $60 per commerce on common.

That’s the ability of a superb reward-to-risk ratio.

However the largest benefit?

There’s method much less stress.

You don’t have to be proper on a regular basis!

Why expectancy issues greater than win charge alone

Most merchants get too targeted on win charge, for a motive that’s straightforward to grasp…

…it feels good to win usually!

However a excessive win charge doesn’t mechanically make you worthwhile.

In case your losses are greater than your wins, a excessive win charge can nonetheless result in unfavourable expectancy, which suggests you slowly bleed cash.

I’ve seen many unsuccessful merchants who prioritise being proper over being worthwhile!

Expectancy tells you whether or not your technique might be profitable in the long run, which is way more essential than specializing in short-term wins.

So subsequent time you see somebody bragging about their win charge, ask them what their expectancy is!

The Stability between Win charge and Danger-to-reward

Like all issues in life, you must discover a stability.

The candy spot for you’ll rely in your persona and buying and selling fashion, which is a key to considering in probabilies.

Some merchants want extra frequent wins and smaller good points.

Others are effective with plenty of small losses in trade for infrequent huge wins.

There’s no explicit “proper method”; the secret’s that your expectancy stays constructive!

As soon as you recognize your numbers, you may form your technique round them.

In case your win charge is low, you’ll want increased reward-to-risk trades.

In case your win charge is excessive, you may afford a bit much less in return, however you’ll nonetheless must keep watch over danger.

See how expectancy offers you a transparent lens to look by?

It helps you make choices based mostly on chance, not hope.

When you begin monitoring it, you’re now not guessing whether or not your technique works; you’ll have proof in entrance of you!

Dropping Streaks Occur Extra Typically Than You Suppose

There’s nothing fairly as irritating as hitting a string of losses.

Even when you recognize your edge is stable, doubt begins to creep in after a number of back-to-back pink trades…

However the factor is: dropping streaks are fully regular.

In reality, they’re anticipated!

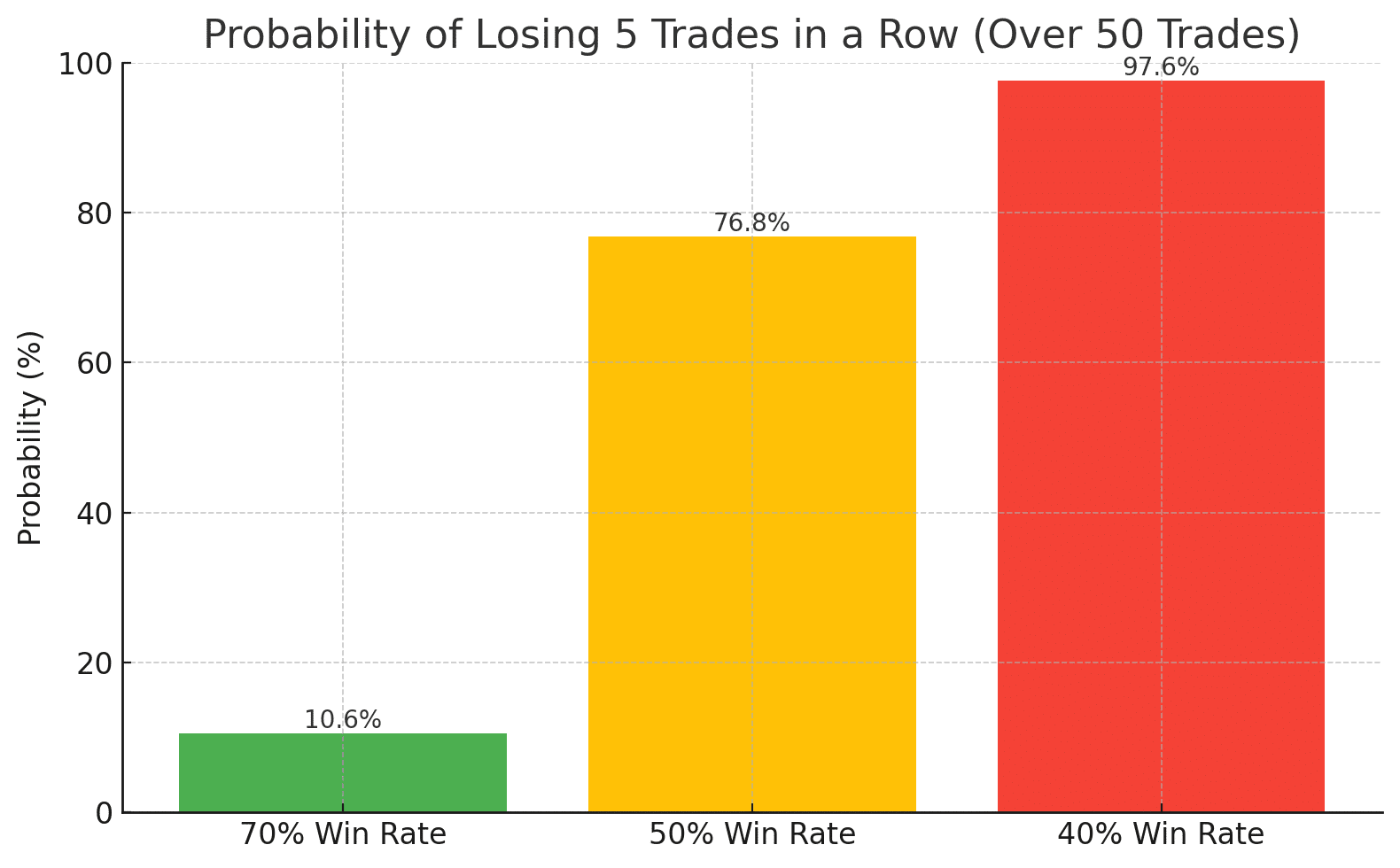

The excellent news is, you may calculate dropping streaks.

On this subsequent part, let’s have a look at how one can work out the probabilities of operating right into a dropping streak, based mostly in your win charge and the variety of trades you’re taking.

When you perceive the way it performs out, you gained’t have to be shocked by them anymore…

…you can begin making ready for them as an alternative!

The right way to Calculate the Odds of a Dropping Streak

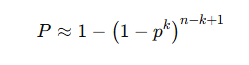

We’ll use a easy however surprisingly correct approximation components to calculate the chance of hitting a minimum of one dropping streak, based mostly on a sure size in a set variety of trades.

Right here’s the components:

The place:

- P is the chance of seeing a minimum of one dropping streak of size okay

- p = your loss charge in decimal kind

- n is the variety of trades

- okay is the size of the dropping streak you’re making an attempt to measure, aka 5 losses in a row, and so forth.

I do know it appears to be like complicated as a components, so let’s do an instance.

To search out P ( The chance ) of a 5 dropping streak with a win charge of 30 p.c over 50 trades…

The equation turns into:

Chance = 1-(1-Loss Proportion^Loss Streak)^ Variety of trades – Loss Streak + 1

P= 1-(1-0.7^5)^50-5+1

This turns into 1-(1-0.7^5)^46

Earlier than I am going additional, the 0.7 quantity comes from the necessity to put in your loss charge, not your win charge; due to this fact, in case your win charge is 30%, your loss charge should be 70%, which in decimal format is 0.7

Due to this fact, over 50 trades, your likelihood of a 5-loss streak with a 30% win charge is roughly 99%

99% means it is going to occur in some unspecified time in the future!

Nevertheless, so long as your expectancy is constructive (as beforehand mentioned), that doesn’t imply the system is damaged.

Let’s plug in some extra numbers and see how usually dropping streaks actually occur, even whenever you’re doing every little thing proper!

Instance 70% Win Fee, Chance of a 5-Dropping Streak

Let’s assume you might have a 70% win charge and you are attempting to seek out the possibility you’ll have a 5 dropping streak inside 50 trades.

So the loss charge is 0.3 (1 minus 0.7), the dropping streak is 5… and the variety of trades is 50.

p=0.3 , okay= 5 , n=50

Plugging it in:

P=1-(1-0.3^5)^46

P=0.1058

P=10.6% likelihood of a five-loss streak – not unattainable.

OK, let’s change it to a 10-loss streak…

Instance 70% Win Fee, Chance of a 10-Dropping Streak

All that should change with this equation is the okay worth.

P=1-(1-0.3^10)^41

P=0.00024

P=0.02% Probability of a 10-loss streak occurring at a 70% win charge.

Uncommon!

What this tells you is that if a 10-loss streak really did happen, it will most likely be time to return and see in case you are utilizing your system precisely because it’s designed.

Let’s do a pair extra for some decrease win charges.

Instance 40% Win Fee, Chance of a 5-Dropping Streak

P=1-(1-0.6^5)^46

P=0.9758

P= 97.6% Probability you’ll encounter a 5 dropping streak inside 50 trades.

That’s fairly the perception when you think about 40% isn’t that low a win charge, proper?

It implies that this occasion is statistically more likely to occur.

It doesn’t imply the system is defective, however it’s extremely helpful data to have whenever you finally come throughout this streak.

Instance 40% Win Fee, Chance of 10 Dropping Streak

OK, what concerning the odds of a ten dropping streak?

Absolutely there may be virtually no likelihood over 50 trades…

However let’s take a more in-depth look.

P=1-(1-0.6^10)^41

P=0.2201

P=22% likelihood that you simply’ll come throughout a 10-losing streak!

22%!

I guess you didn’t suppose it will be that seemingly, proper?

Nevertheless, this can be a nice instance of the realities you’ll face when buying and selling that system.

You’ll incur some drawdown, however so long as your expectancy is constructive, you’ll come out the opposite finish of it…

Why It Issues

When you realise how frequent these streaks are, they cease being so threatening.

A dropping streak doesn’t essentially imply your system is damaged…

…it simply means your system is taking part in out precisely as chance says it might!

So don’t panic when the reds stack up.

In case your win charge and risk-to-reward are stable, the losses will be taken as a part of the larger image, not the entire story.

Follow the plan, handle danger, and keep in mind: it’s not concerning the subsequent commerce.

It’s concerning the subsequent 50, 100, 500.

I invite you to mess around with these numbers and take a look at them on bigger scales: 100+ trades or extra, to realize higher long-term perception into what could happen in your buying and selling journey!

The End result of a Single Commerce Is Random

So, how does all this come collectively?

One of many largest psychological shifts you must make as a dealer is that this:

You are able to do every little thing proper and nonetheless lose.

It doesn’t should be a flaw in your technique…

It doesn’t should be an indication you’re unhealthy at buying and selling…

…it’s simply the character of the sport.

The result of any single commerce is completely random, even when the chances are in your favor.

Why Randomness Issues

Let’s say you’ve acquired a method with a 60% win charge.

You now know that this doesn’t imply 6 out of each 10 trades will win so as.

The market doesn’t take note of what’s “due.”

You possibly can get a string of 5 losers, then hit 7 winners in a row.

The possibilities play out over longer time durations, not in neat, predictable patterns.

Within the quick time period, randomness is king.

And that’s precisely why you may’t choose your edge based mostly on a single commerce, or perhaps a handful.

It’s way more essential to evaluate whether or not or not you adopted your course of.

That’s what actually issues.

End result Bias: The Psychological Lure to Keep away from

So what’s the most typical entice most merchants fall into?

Properly, they choose single trades by their particular person outcomes!

Is it a win?…

…it should’ve been a superb commerce.

Is it a loss?…

…effectively, I have to’ve completed one thing improper.

That is what I wish to name end result bias, and belief me, it’s harmful!

It fully ignores how one can suppose in possibilities, because it focuses solely on what occurs after.

However step again, and you may see the results of any explicit single commerce is usually noise.

It’s random.

It doesn’t essentially have something to do with the standard of your course of.

Let me provide you with an instance.

Think about a dealer has a rule: danger 1% per commerce. Their cease loss is about based mostly on construction and never moved as soon as the commerce is reside.

In the future, they enter a commerce, however the worth begins pushing towards their cease faster than anticipated.

They panic and transfer the cease somewhat additional and inform themselves they’re “Simply giving it some extra room.”

The market pulls again… after which reverses.

Increase!

Revenue hits.

They only turned a possible loser right into a winner.

Feels good, proper?

They inform themselves, “Perhaps I ought to give my trades extra room any longer…”

However that may be a mistake!

That thought is a direct results of end result bias.

Wanting again, the choice to maneuver the cease was emotional.

It broke their rule…

It wasn’t backtested…

…however the end result was a win.

A win that, sadly, gave validity to a foul behavior (emotional buying and selling)!

So, quick ahead two weeks.

Similar setup.

The market pushes towards the dealer once more.

Feeling assured, they shift the cease once more… perhaps even somewhat extra this time.

However what occurs?

The road retains going…

…and going!…

What ought to’ve been a 1% loss is now 3%, perhaps 4%.

This one commerce eats away at what took three winners to construct!

Properly, now the dealer is shaken and pissed off.

They could even find yourself caught in a cycle, all as a result of one random win gave them permission to disregard their edge.

See how detrimental this may be?

So what’s the answer?

Take into account course of over end result!

All the time keep in mind:

A very good commerce is one which follows your plan, even when it loses.

A foul commerce is one which breaks your guidelines… even when it wins!

When you let random outcomes form your conduct, you’ll drift away out of your edge, and it’ll meet up with you ultimately.

When your habits get strengthened by randomness, you construct a system round hope… not considering in possibilities.

And whereas end result bias is refined, it’s undoubtedly lethal.

One of the best merchants be taught to detach from particular person outcomes and keep loyal to the method.

As a result of they perceive that’s the place the consistency will be discovered.

Your job isn’t to guess which commerce will win.

Your job is to execute a method that wins over time.

Random short-term, constant long-term

One of the simplest ways to visualise that is to think about flipping a biased coin.

Let’s say heads wins you $2 and tails loses you $1.

You’re buying and selling with an edge.

The maths is in your facet.

However even then, you may flip 5 tails in a row.

It doesn’t imply the coin is damaged!

It simply means you’re working by short-term randomness.

Maintain out lengthy sufficient, and that edge turns into clearly seen once more.

The extra trades you’re taking, the extra the regulation of huge numbers kicks in, and the extra constant your outcomes develop into.

So whenever you’re tempted to overreact to at least one loss or one win, keep in mind: the results of a single commerce doesn’t imply something by itself.

However sticking to your edge over a collection of trades?

That’s every little thing.

So, how do you keep away from undoing all this tough work?

One sensible tip is to suppose in teams of trades.

Let’s have a look.

Considering in Teams of Trades

If there’s one idea that may fully change the best way you commerce and the way you deal with the emotional ups and downs, it’s this:

Cease fascinated with particular person trades and begin considering in teams of trades as an alternative.

The issue with single-trade considering

Most merchants get overly targeted on what simply occurred.

Perhaps you’re taking a loss and really feel defeated.

Or maybe you’re taking a win and really feel invincible!

Both method, you begin attaching which means to each end result, considering every commerce is a mirrored image of your ability or lack of it…

…however that is the place actuality begins to interrupt down.

As a result of regardless of how good your edge is, the end result of 1 commerce is mainly a coin flip.

If you’re emotionally invested in each single consequence, you’re always swinging between confidence and doubt.

It’s a harmful sample that results in revenge buying and selling, skipping setups, doubting your system, and finally, blowing up your edge.

Your edge solely reveals itself over time

Method buying and selling like a supervisor operating a on line casino.

You don’t must care about somebody’s hand on the blackjack desk.

It’s all concerning the hundreds of arms over time, as a result of that’s the place their edge performs out.

It is best to construction your buying and selling technique in the identical method.

In case your system has a constructive expectancy, which means it’s mathematically worthwhile over time, then your job is to execute that system throughout a big sufficient pattern measurement.

It’s solely by doing in order that your edge can begin to shine by!

Not after 3 trades…

Not after 10 trades…

However after 50, 100, even 500+ trades.

Why This Shift Issues

Considering in possibilities by commerce teams as an alternative of single trades helps you:

- Keep emotionally secure throughout drawdowns

- Keep away from overreacting to random outcomes

- Construct confidence in your course of

- Give attention to execution, not simply outcomes

So the following time you hit a dropping streak or get a fortunate win, take a step again and ask:

Am I getting hung up on single trades, or…

…am I following my edge over a collection of trades?

Truthfully, this must be liberating, that newfound information that when in drawdown, the possibilities are it means nothing!

You aren’t doing something improper, you didn’t out of the blue develop into a foul dealer… It’s merely statistical odds taking part in out.

So, it offers you a allow to commerce freely and relentlessly, proper?

Properly, that brings me to my final level…

Figuring out your numbers!

The right way to Suppose in Chances: Know Your Numbers

You possibly can have one of the best setup, the cleanest chart, and a method with edge, however should you don’t know your numbers… you’re flying blind!

It’s the numbers that provide you with readability.

Numbers take the guesswork out of buying and selling and provide help to separate emotion from execution.

It’s all the way down to them that backtesting, journaling, and efficiency monitoring all come into play, too.

As a result of whereas the end result of a single commerce may be random, your long-term outcomes usually are not!

As a substitute, they’re constructed on information.

And whether or not you prefer it or not, information exhibits us actuality.

Why Backtesting Issues

Backtesting isn’t about discovering the proper technique.

It’s about understanding how your technique performs over time.

If you backtest correctly, you uncover key stats that I’ve talked about on this article:

- Your win charge

- Your common reward-to-risk ratio

- Your anticipated most drawdown

- Your expectancy per commerce

These numbers can inform you what to anticipate…

…not simply when issues are going effectively, however after they’re going improper, too!

In case your backtesting exhibits you’re more likely to have a 6-trade dropping streak as soon as each 100 trades, then when it occurs, you gained’t be shocked.

As a substitute, you’ll really be ready.

On this sense, backtesting offers you a baseline.

When the reside outcomes match that baseline, it builds confidence.

In the event that they deviate, it tells you one thing may want adjusting.

However both method, it helps you belief the method.

So already you may see how information offers you a map of the place you might be, whether or not one thing appears off, or if the course is evident to proceed shifting ahead!

Confidence Comes From Information

You understand that feeling whenever you hit a drawdown and begin questioning every little thing?

We’ve all been there, me included!

It’s regular, nevertheless it’s avoidable.

Nevertheless, when you recognize your system has gone by comparable stretches earlier than and stays worthwhile, you’re more likely to remain the course.

The market is unsure, however your technique doesn’t should be.

If you’ve seen your edge play out over tons of of trades in a backtest, it turns into lots simpler to push by momentary slumps in reside circumstances.

That is key to managing expectations.

Managing expectations

Let’s be sincere: most merchants don’t blow up as a result of their system doesn’t work; they blow up as a result of they couldn’t deal with the emotional swings that include not figuring out what to anticipate.

If you recognize your system’s historic drawdown is 12%, you gained’t panic whenever you’re down 10%.

However should you don’t know that quantity?

Each dip seems like a catastrophe!

You begin altering methods, altering your method mid-drawdown, or abandoning setups which can be nonetheless legitimate.

Figuring out your numbers offers you emotional self-discipline since you’re not guessing.

You’re following a framework that’s confirmed itself over time.

So earlier than you ask whether or not your technique “works,” ask your self:

Do I do know what my system really does?

Properly, should you don’t… monitor it!

Backtest it!

Perceive it in and out.

As a result of the extra you recognize your numbers, the extra energy you might have over your outcomes.

Conclusion

By now, you may most likely see that buying and selling isn’t nearly discovering the best setup.

It’s simply as a lot about understanding the numbers behind your edge and the mindset wanted to keep it up by the ups and downs.

Which is the important thing to on how one can suppose in possibilities.

Keep in mind that the market will all the time throw randomness your method.

You’ll expertise dropping streaks, shock wins, setups that ought to’ve labored however didn’t, and trades that had no enterprise successful however did anyway.

It’s a part of the statistics sport.

What separates constant merchants from pissed off ones is how they interpret these outcomes and, extra importantly, how they reply.

If you wish to construct long-term consistency, this text ought to provide the psychological and mathematical basis to do exactly that.

Right here’s what you’ve taken away:

- A transparent understanding of possibilities and the way they affect each commerce you’re taking

- How expectancy ties your win charge and risk-reward collectively to form profitability

- Why dropping streaks are inevitable and how one can calculate the chances of them taking place

- The hazard of end result bias, and why following your plan issues greater than short-term outcomes

- The right way to suppose in teams of trades quite than judging every commerce in isolation

- The significance of figuring out your numbers by backtesting and monitoring so you may handle expectations and keep grounded

Buying and selling with confidence doesn’t come from avoiding losses; it comes from understanding why they occur, how usually they occur, and what they actually imply.

Now I’d love to listen to from you.

How has considering in possibilities modified your method to buying and selling?

Have you ever skilled end result bias or a tricky dropping streak not too long ago?

Drop your ideas within the feedback under.