Most buyers consider Treasury payments—the short-term, “risk-free” U.S. authorities debt—as the final word protected haven. No credit score threat, extremely liquid, assured by Uncle Sam. That is all true on a nominal foundation. T-bills have by no means had a drawdown or misplaced cash.

Nonetheless we stay in a “actual” world, that means, all that issues is “after inflation”, or what is named “actual returns”.

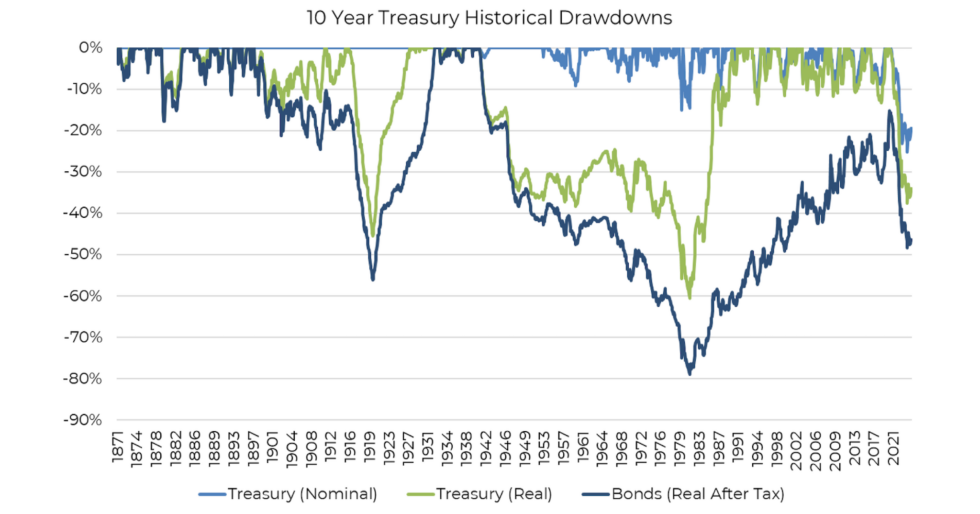

Here’s a stat that blows up standard knowledge: Through the twentieth century, the peak-to-trough actual drawdown for U.S. T-bills, after adjusting for inflation, was practically -50%. (10-Yr US authorities bonds have been worse with a 60% max actual drawdown.)

That’s proper. Your “protected” funding quietly misplaced over half its buying energy.

I polled buyers to see what number of really understood this uncomfortable actuality.

The bulk, practically two thirds of respondants, underestimated the danger. A full 16% assumed T-bills had zero or small drawdownxs. And it’s no shock—this isn’t one thing Wall Road talks about when pitching security and safety.

What you see is a graveyard of misplaced buying energy throughout prolonged inflationary regimes—World Wars, the Nineteen Seventies, you identify it. On paper, your T-bills stayed intact. However in actual phrases, your wealth slowly evaporated.

Even worse, should you’re a tax payer, the return on bonds after taxes is mainly….zero. through our associates at Aptus.

The lesson?

There’s no such factor as a free lunch. Even the most secure property carry hidden dangers—typically within the type of inflation erosion, alternative price, or long-term drawdowns that fly below the radar.

When you park all of your capital in “protected” money equivalents for many years, historical past exhibits you’re nonetheless in danger—simply in a special, quieter means. We’ll come again to this matter later once we study what precisely is the most secure asset?