The bears are actually left greedy at straws. What about tariffs? What about inflation? What about recession? What concerning the Fed? What about rates of interest? What concerning the Center East? What concerning the deficits? Blah, blah, blah.

On the subject of the media, it’s good to bury your head within the sand. Truly, take your head out of the sand and bury it within the charts. That is the place you will discover the reality.

I mentioned all-time highs have been coming again on the April low and right here we’re. The S&P 500 has set a brand new all-time report excessive immediately and, barring a major afternoon decline, will set its all-time closing excessive above the earlier closing excessive of 6144, which was set on February 19, 2025. This new excessive comes simply as we start to arrange for Q2 earnings season. The run as much as earnings season is mostly and traditionally fairly sturdy, so prepare for extra highs forward.

Since 1950, the S&P 500 has produced annualized returns of almost 27% in the course of the interval June twenty eighth by way of July seventeenth. This annualized pre-earnings run is sort of triple the common S&P 500 annual return of 9% since 1950. Care to guess how the NASDAQ and Russell 2000 have fared throughout this bullish pre-earnings interval?

- NASDAQ: +38.67%

- Russell 2000 (IWM): +32.61% (bullish interval ends July fifteenth for small caps)

Clearly, the bulls have the historic benefit for the following 3 weeks. Technically, proof started turning within the bulls’ favor in mid-March, regardless of the final huge transfer decrease in early April. I’ve the analysis to again that up and can focus on it at an occasion on Saturday (extra particulars under). Whereas the inventory market was quickly declining in April, Wall Road was fortunately stealing everybody’s shares in the course of the panicked selloff.

Technical Energy

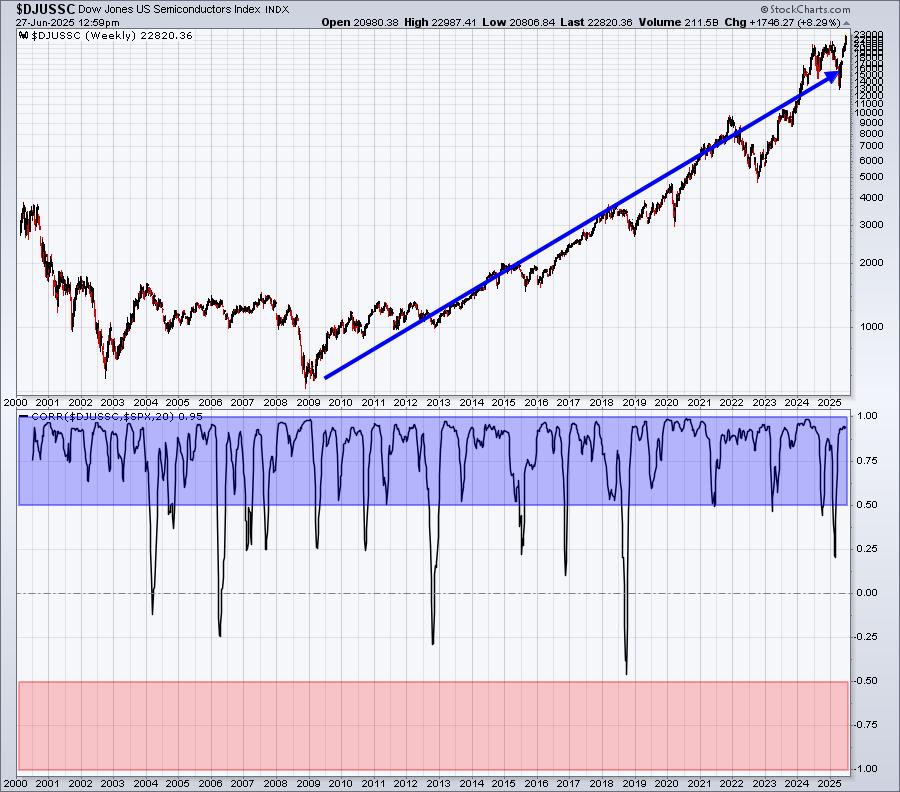

Two of a very powerful business teams to comply with are semiconductors ($DJUSSC) and software program ($DJUSSW). These two teams are among the many most influential by way of driving the S&P 500 larger. Try each of those charts and make sure to try each absolutely the and relative power presently.

Semiconductors:

Software program:

Now I will present charts of those similar two teams, however this time present you the way positively they correlate to the S&P 500’s route over the course of this century.

Semiconductors:

Software program:

Truthfully, you do not want a PhD in Economics to know the above charts. It is actually fairly easy. When semiconductors and software program are rallying to new highs and displaying relative power, BUY U.S. shares! They each have extraordinarily tight optimistic correlation with the S&P 500 they usually each look very technically sound correct now.

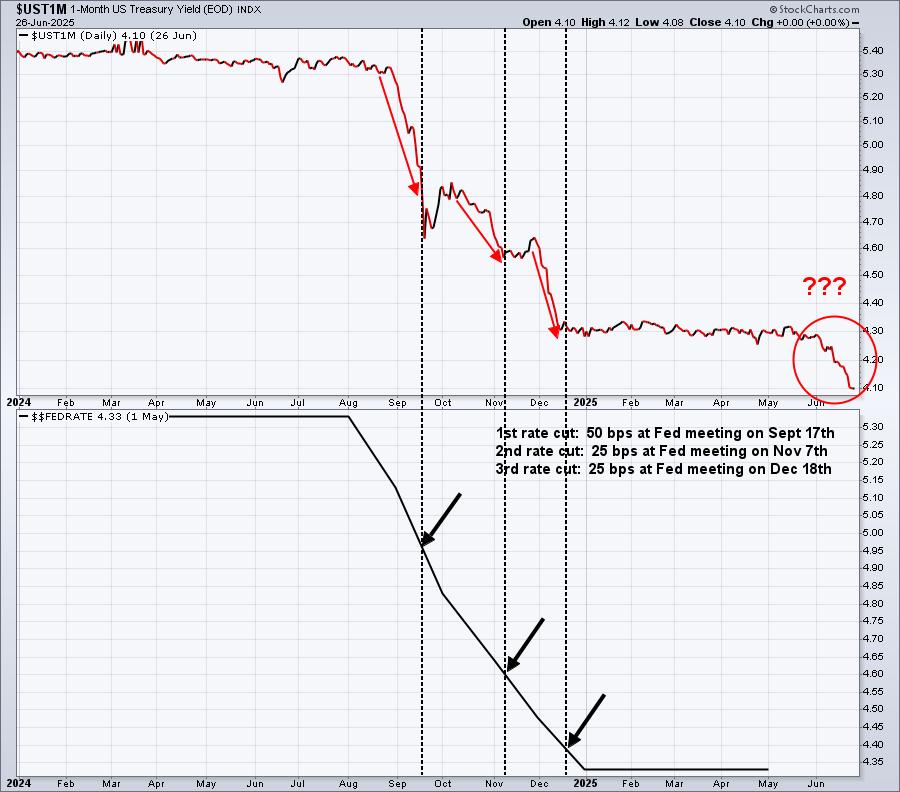

Curiosity Fee Reduce

It is coming and it is coming quick! I am now satisfied that the Fed will minimize the fed funds price in a month at their subsequent scheduled assembly on July 29-30. I am not saying it as a result of I really feel the Fed ought to minimize or wants to chop. I am saying it as a result of there is a ton of shopping for proper now within the 1-month treasury, sending its yield down. The 1-month treasury yield ($UST1M) usually begins to maneuver BEFORE any Fed motion happens. We noticed it again in August/September 2024, simply previous to the 50 foundation level minimize on the September 2024 assembly:

The black directional strains within the backside panel mark roughly the date that the Fed lowered the fed funds price. The pink directional strains within the prime panel spotlight the downward motion within the $UST1M PRIOR to the Fed’s decreasing roughly a month later. Once more, I am not making these things up. The charts are telling me a narrative right here and the present story is that charges are about to return down.

Checkmate bears.

Observe the charts, not the media!

The Sport

I am starting to consider that capitulation is nothing greater than a staged occasion for the Wall Road elite and we are the panicked pawns working round with our hair on fireplace. These days are over for EarningsBeats.com members. We noticed this one coming, identical to we noticed it coming in 2022. Getting out on the prime with the Wall Road elite and getting again in on the backside earlier than them is a superb recipe for beating the S&P 500 by a mile!

Studying is the important thing. We give attention to market analysis, steerage, and schooling at EarningsBeats.com. These are our 3 pillars of enterprise. Calling the 2025 market prime wasn’t a coincidence. We have finished it earlier than and we’ll do it once more. Leaping again in close to the underside was no coincidence both. Our indicators are confirmed they usually work.

On Saturday morning at 10:00am ET, we’re internet hosting a FREE instructional occasion, “Buying and selling the Fact: How Market Manipulation Creates Alternative”. I will present everybody the “play-by-play” of how we have been in a position to transfer to money BEFORE the market prime and again into shares NEAR the market backside. Market tops type with most of the similar indicators every time. To be taught extra about this occasion and to register along with your title and e mail tackle, CLICK HERE.

For those who’ve struggled with all of the uncertainty in 2025 and have not trusted shares, it is time that you just change your course of and techniques. I will see you on Saturday!

Glad buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person buyers. Tom writes a complete Every day Market Report (DMR), offering steerage to EB.com members day-after-day that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a elementary background in public accounting as nicely, mixing a novel talent set to method the U.S. inventory market.