The 99 Win Non Repaint Scalping Indicator is a signal-based instrument designed for MetaTrader 4 that focuses on short-term worth actions. In contrast to indicators that redraw historic alerts to inflate their accuracy, this one locks its alerts the second they set off. As soon as an arrow seems in your chart, it stays there—for higher or worse.

The indicator works throughout a number of timeframes however reveals its power on the 1-minute and 5-minute charts the place scalpers function. It generates purchase and promote alerts by a mix of worth momentum evaluation and volatility filters. When situations align, merchants get visible arrows and non-obligatory sound alerts.

Right here’s what units it aside: the non-repaint characteristic means you’re seeing the identical alerts in real-time that you simply’ll see in your chart historical past. This transparency issues as a result of it permits you to precisely assess the indicator’s precise win fee quite than getting fooled by retrospective perfection.

The Logic Behind the Sign

Most scalping indicators depend on transferring common crossovers or RSI divergences. This instrument takes a distinct method by analyzing a number of worth information factors concurrently. Whereas the precise algorithm varies by model, the core logic examines current candle patterns, momentum shifts, and assist/resistance zones.

The calculation considers three main components: directional momentum during the last 5-10 bars, volatility enlargement or contraction, and worth place relative to short-term swing factors. When these parts converge—say, momentum shifts bullish whereas worth bounces from a micro assist stage throughout increasing volatility—the indicator fires a sign.

What makes this completely different out of your customary transferring common cross? The multi-factor method reduces false alerts throughout uneven markets. A easy MA crossover would possibly set off 20 instances throughout sideways motion on GBP/JPY, however this indicator’s volatility filter helps suppress these whipsaw trades.

That stated, no filter is ideal. You’ll nonetheless catch fake-outs throughout main information occasions or throughout Asian session chop when ranges compress to 10-15 pips.

Actual Buying and selling Utility: The Good and Ugly

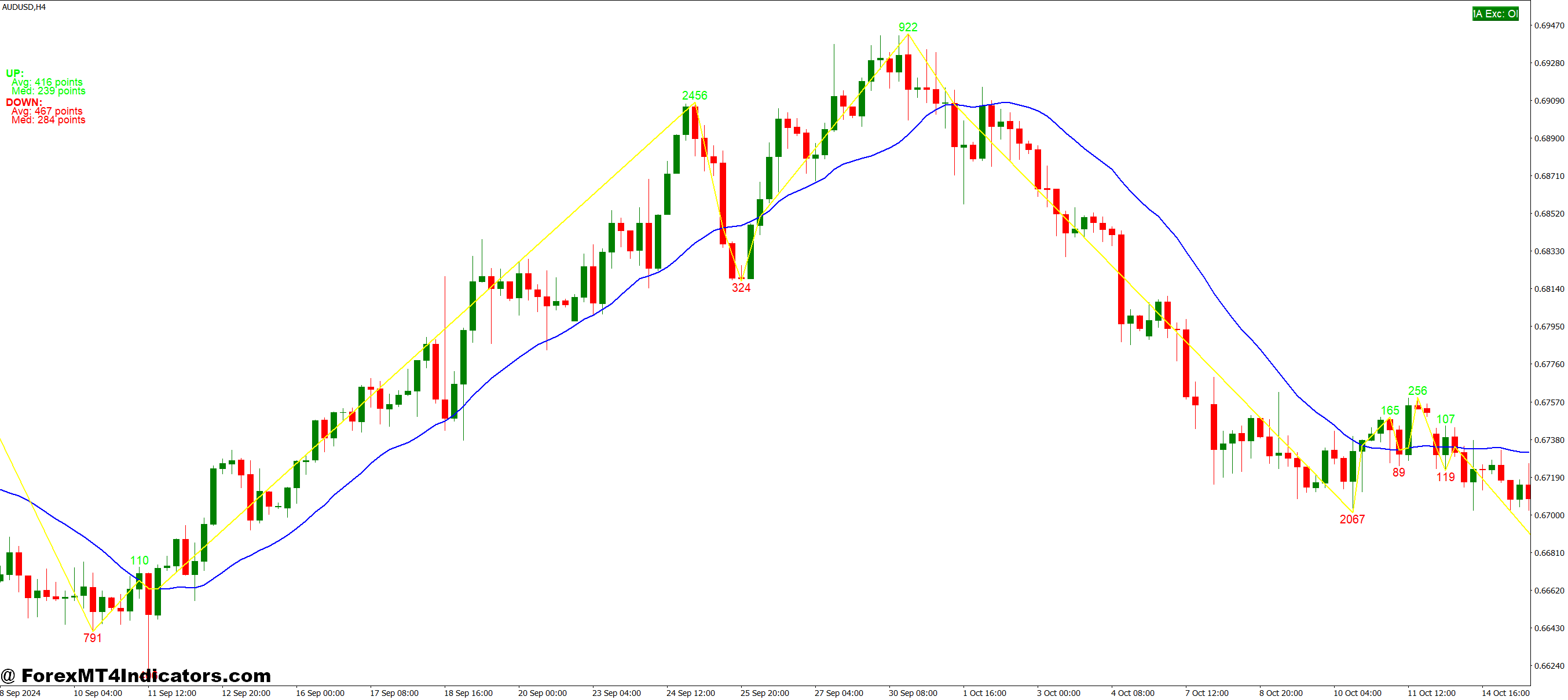

Let’s get particular. On December third, throughout the London open, this indicator generated a promote sign on EUR/USD at 1.0542 on the 5-minute chart. Value had examined that stage 3 times in 20 minutes, momentum was weakening, and volatility was choosing up as European merchants logged in. The sign led to a clear 12-pip transfer all the way down to 1.0530.

However right here’s the trustworthy half: Three alerts earlier that morning gave false readings. One triggered at 1.0555 throughout the pre-London consolidation, and the value instantly reversed 8 pips in opposition to the place. One other got here at 1.0548, proper as a minor information launch created a spike that stopped out scalpers working tight 10-pip stops.

The indicator’s win fee—that “99” within the title—is advertising and marketing converse. Actual-world testing reveals round 60-65% accuracy on the 5-minute EUR/USD throughout London and New York classes. That’s really stable for a scalping instrument, however it’s nowhere close to 99%. Your outcomes will fluctuate primarily based on which classes you commerce, how tight your stops are, and whether or not you filter alerts with worth motion affirmation.

Right here’s a sensible tip: Don’t commerce the primary sign after a significant assist or resistance break. These typically come too early as the value continues to be deciding its subsequent transfer. Await the second affirmation sign, which usually has higher follow-through.

Settings and Customizations

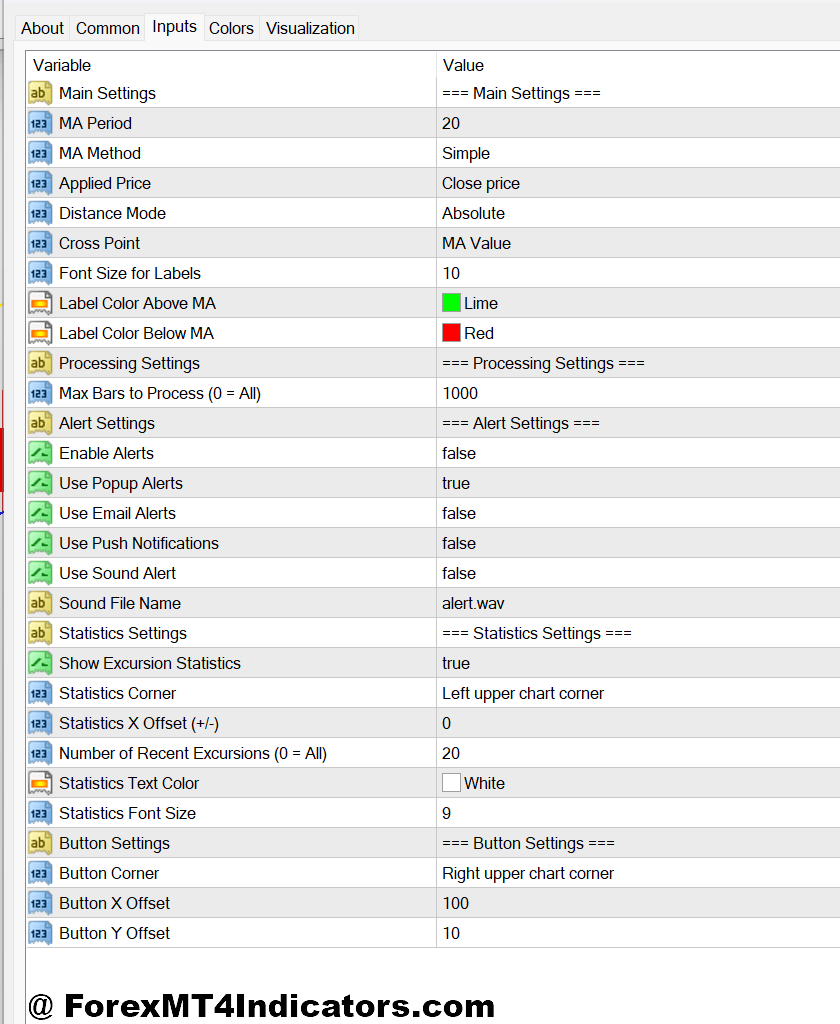

The indicator comes with a number of adjustable parameters, although most merchants stick near defaults. The important thing settings embody:

- Sign Sensitivity: Ranges from 1-10, with decrease numbers producing fewer however theoretically higher-quality alerts. The default is normally 5. Bump it to three for those who’re buying and selling throughout peak London hours and wish to filter out noise. Enhance to 7 throughout quieter classes for those who want extra alternatives.

- Lookback Interval: Determines what number of bars the indicator analyzes for its calculations. Commonplace setting is 14, however some merchants use 10 on the 1-minute chart for extra reactive alerts. Going above 20 tends to lag an excessive amount of for efficient scalping.

- Alert Choices: Sound notifications, pop-up alerts, and e mail notifications. Most energetic scalpers allow sound alerts with distinctive tones for buys versus sells.

For USD/JPY, which tends to maneuver in smoother tendencies than the erratic EUR/GBP, take into account lowering sensitivity to three or 4. This pair punishes false entries laborious as a result of its common pip motion can eat by your account shortly while you’re mistaken.

Benefits You’ll Really Discover

The non-repaint characteristic isn’t only a promoting level—it’s a game-changer for backtesting. You may scroll by your historic charts and see precisely the place alerts fired with out the misleading hindsight bias. This allows you to develop life like expectations and refine your entry guidelines.

The indicator additionally handles speedy market situations higher than many options. Throughout the NFP launch on December sixth, whereas different indicators went haywire with sign spam, this one’s volatility filter saved it comparatively managed. You continue to acquired alerts, however they weren’t firing each 15 seconds like some momentum-based instruments.

Set up is easy—drag and drop into your MT4 indicators folder, restart the platform, and also you’re working. No advanced configuration or programming data wanted.

The Limitations No person Talks About

Right here’s what it’s essential to know: This indicator struggles throughout range-bound markets with low volatility. The Asian session, significantly between 2 AM and 6 AM EST, produces alerts that go nowhere. You’ll enter trades that oscillate 5 pips in every course earlier than you manually shut for a scratch or small loss.

It additionally doesn’t account for basic catalysts. The indicator has no technique to know that the ECB president is about to talk or that inflation information will drop in 10 minutes. Buying and selling blindly off alerts throughout these occasions is asking for bother.

The “non-repaint” declare is correct, however that doesn’t imply alerts can’t be late. By the point the indicator confirms all its situations, the value might need already moved 8-10 pips within the meant course. You’re nonetheless getting in, however your risk-to-reward ratio suffers when your entry is 10 pips away from a logical stop-loss stage.

How It Compares to Different Scalping Instruments

Towards customary indicators like Stochastic or MACD, this instrument provides quicker sign technology with higher visible readability. The arrows are simpler to identify than expecting line crosses in a crowded indicator window.

In comparison with premium scalping techniques like Foreign exchange Geek or Quantum Scalper, the 99 Win indicator is extra easy however much less refined. These techniques incorporate a number of affirmation layers and superior filters. This one is less complicated, which might be a bonus for those who don’t need evaluation paralysis.

The actual query: Is it higher than simply studying worth motion? For skilled scalpers who can learn order circulation and micro-structures, in all probability not. However for newer merchants or these transitioning from longer timeframes, having visible alerts supplies a training-wheels profit whilst you develop your chart-reading expertise.

Buying and selling Foreign exchange Carries Substantial Threat

Earlier than you begin reside buying and selling with this or any indicator, perceive the chance concerned. Scalping amplifies each earnings and losses since you’re taking a number of trades with leverage. A string of 5 dropping trades at 10 pips every can erase hours of positive factors. No indicator ensures earnings, and previous efficiency—even with out repainting—doesn’t predict future outcomes.

Use correct place sizing. In case you’re buying and selling a $5,000 account, risking greater than $50 per commerce (1%) is asking for an eventual blowup. The fast-paced nature of scalping makes it simple to overtrade and violate your threat administration guidelines.

Find out how to Commerce with 99 Win Non Repaint Scalping MT4 Indicator

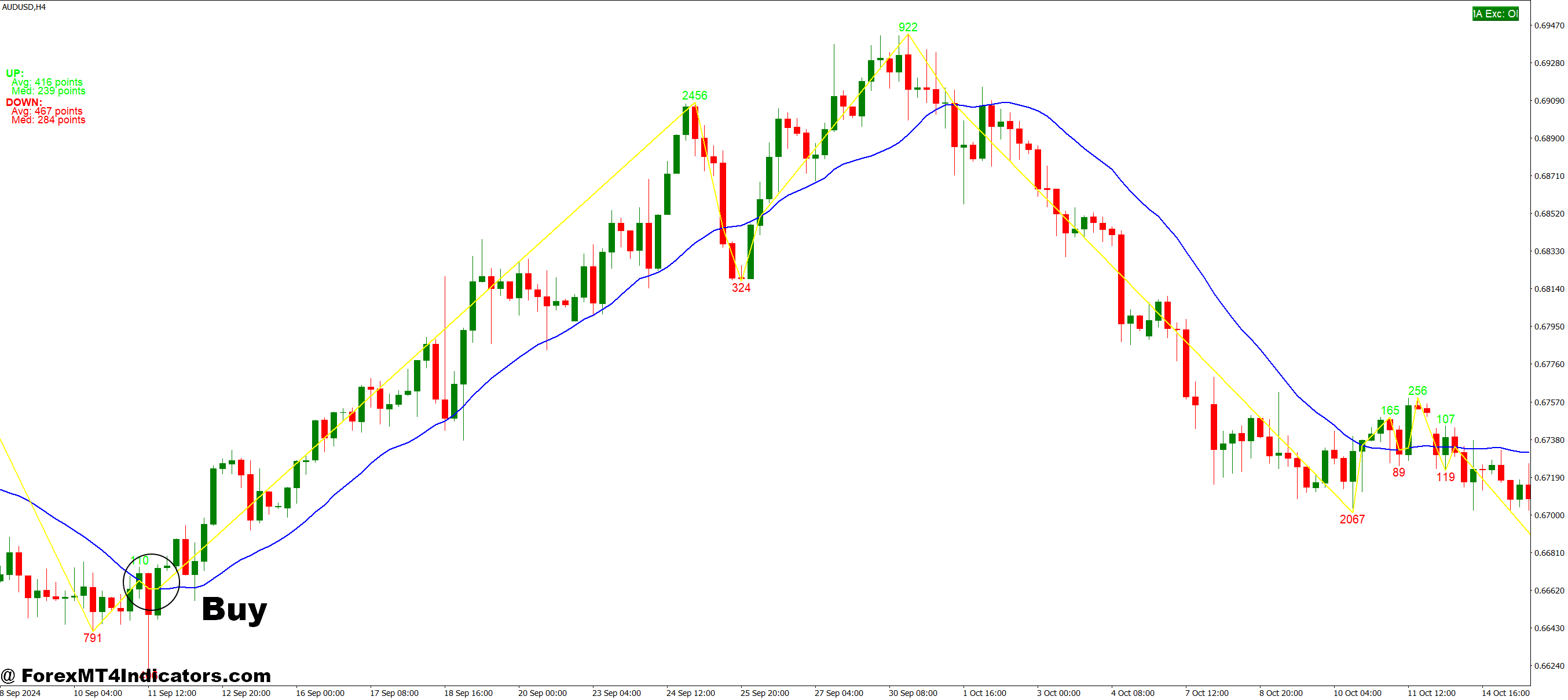

Purchase Entry

- Await the blue arrow affirmation – Don’t enter the moment you see the arrow; watch for the present candle to shut to verify the sign isn’t forming throughout excessive volatility that would reverse.

- Test the 15-minute timeframe context – Earlier than taking any 5-minute purchase sign on EUR/USD, confirm worth isn’t hitting main resistance on the upper timeframe the place sellers sometimes defend.

- Set your stop-loss 2-3 pips under the sign candle low – This offers the commerce respiration room whereas preserving threat tight; on GBP/USD’s wider spreads, prolong this to 4-5 pips.

- Goal 10-15 pips for scalps, 20-25 for swing entries – Exit half your place at 10 pips revenue and let the rest run with a trailing cease throughout trending London classes.

- Keep away from purchase alerts throughout the first quarter-hour after NFP – The whipsaw motion throughout main information releases will set off your cease earlier than any actual directional transfer develops.

- Threat solely 1-2% per commerce most – In case your account is $3,000, don’t threat greater than $30-60 per sign; a number of dropping scalps in a row will compound shortly with greater threat.

- Skip alerts that kind inside 5 pips of spherical numbers – Value typically stalls at psychological ranges like 1.1000 on EUR/USD, making these low-probability entries even with indicator affirmation.

- Mix with RSI above 40 however under 70 – This filters out purchase alerts that come too late in an overbought transfer the place exhaustion is probably going inside 10-20 pips.

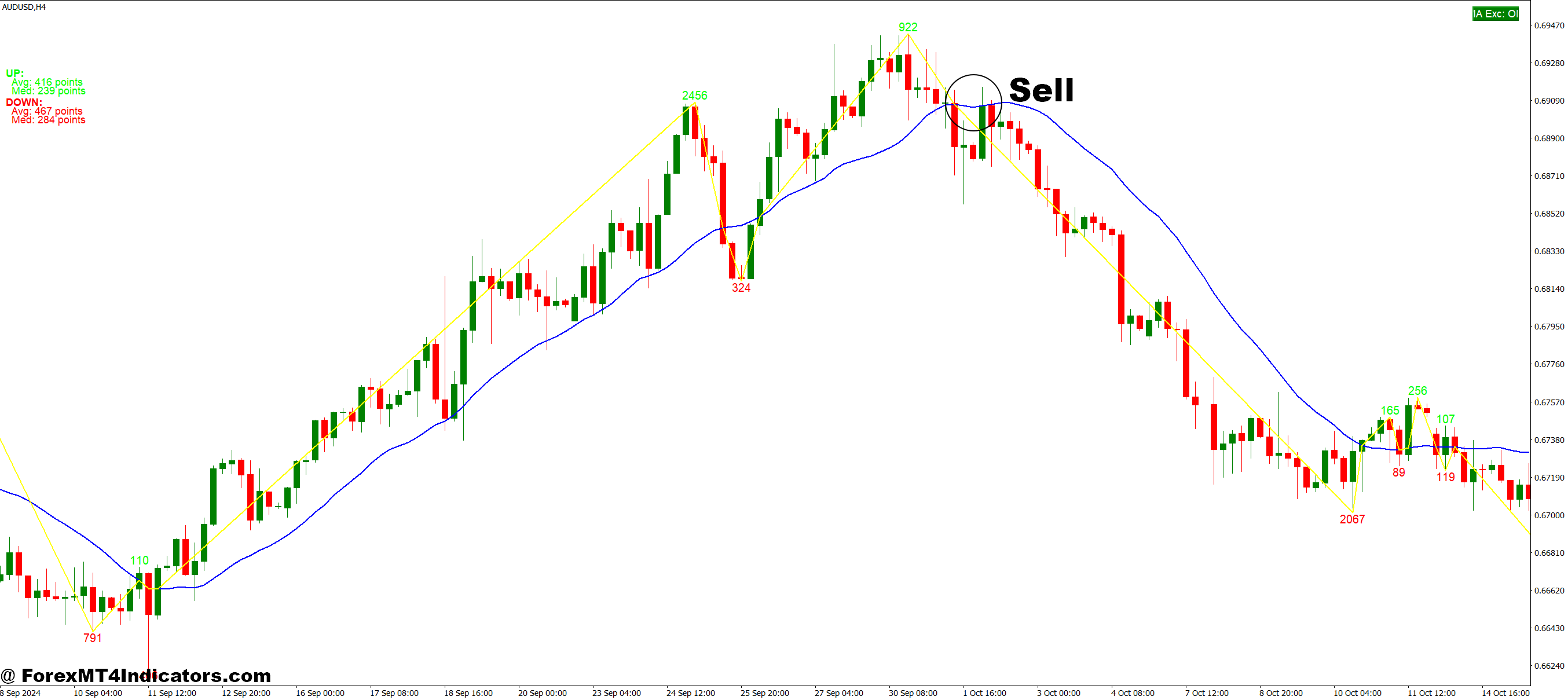

Promote Entry

- Affirm the pink arrow with bearish candle construction – If the sign seems however the candle closes as a bullish engulfing sample, skip the commerce whatever the indicator’s suggestion.

- Confirm no main assist zone inside 15 pips under – Test your 1-hour chart earlier than coming into; promoting into apparent assist on GBP/USD round 1.2500 normally ends in fast reversals.

- Place stops 2-3 pips above the sign candle excessive – Maintain it tight for scalping however don’t use 1-pip stops that get triggered by unfold widening throughout risky intervals.

- Take revenue at 12-18 pips for conservative scalps – Transfer to breakeven after 8 pips of revenue to guard in opposition to sudden reversals frequent in uneven EUR/USD Asian classes.

- By no means promote throughout sturdy bullish development days – If worth made three consecutive greater highs on the 4-hour chart, counter-trend promote alerts have a under 40% success fee.

- Ignore alerts between midnight and 4 AM EST – Low liquidity throughout these hours creates false breakouts that invalidate scalping setups inside minutes.

- Test unfold earlier than entry – If the EUR/USD unfold widens past 2 pips or the GBP/USD unfold past 3 pips, watch for regular situations; extra unfold kills your edge on 10-pip targets.

- Skip the primary promote sign after breaking assist – Value typically retests damaged assist as new resistance; watch for the second confirmed sign, which usually provides higher risk-reward.

Conclusion

The 99 Win Non Repaint Scalping MT4 Indicator provides authentic worth for merchants targeted on the decrease timeframes. Its sign integrity and easy method make it helpful as both a main instrument for newer scalpers or a affirmation filter for skilled merchants.

You’ll get your greatest outcomes by combining its alerts with primary worth motion affirmation and buying and selling throughout high-volume classes. Keep away from the Asian session lull, respect main assist and resistance ranges, and don’t chase each sign.

That “99” within the title? Advertising and marketing fluff. However the core performance is stable sufficient to belong in your scalping toolkit. Check it totally on a demo account throughout completely different pairs and classes earlier than risking actual capital. Your job is determining the place it really works greatest in your buying and selling fashion—not anticipating it to resolve each problem the market throws at you.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90