It’s a incontrovertible fact that profitable merchants suppose and act very in a different way from unsuccessful merchants. In at the moment’s lesson on the unknown and infrequently mentioned habits of profitable merchants, we’re going to talk about a few of the most vital variations between successful and dropping merchants. We are going to have a look at how they suppose, how they act and what they do every day. This lesson goals to supply each newbie and superior merchants some much-needed perception into the mindset and actions of an expert dealer, permitting you to begin mimicking these habits and in the end enhancing your buying and selling outcomes.

It’s a incontrovertible fact that profitable merchants suppose and act very in a different way from unsuccessful merchants. In at the moment’s lesson on the unknown and infrequently mentioned habits of profitable merchants, we’re going to talk about a few of the most vital variations between successful and dropping merchants. We are going to have a look at how they suppose, how they act and what they do every day. This lesson goals to supply each newbie and superior merchants some much-needed perception into the mindset and actions of an expert dealer, permitting you to begin mimicking these habits and in the end enhancing your buying and selling outcomes.

You’ve heard it earlier than I’m certain, however I’m going to say it once more as a result of it’s so true: For those who maintain doing what you’ve at all times completed you’ll maintain getting what you’ve at all times bought. So, the query turns into, the place are you now along with your buying and selling? Are you profitable, or not? If you’re not blissful along with your buying and selling efficiency, then it’s time to do one thing completely different! Hopefully, the next unknown and infrequently mentioned habits of profitable merchants will enlighten you and get you on the trail to worthwhile buying and selling…

We Suppose Like Hedge Funds, No matter Our Account Measurement

I in all probability commerce a a lot bigger place dimension than most of you studying this proper now, and I’m not bragging in any respect. I’m telling you that as a result of I’ve been the place you’re at and after being there and transferring to the place I’m now, I can let you know that account dimension merely doesn’t matter for probably the most half. It doesn’t matter within the sense that should you can’t commerce efficiently on a $1,000 account you received’t commerce efficiently on a $10,000 or $100,000 account both. Account dimension means nothing should you can not commerce correctly.

Nevertheless, account dimension can certainly amplify your positive factors and a bigger account can change your life sooner than a small one as a result of income (or losses) are clearly larger the larger positions you’ll be able to commerce. However, earlier than you’ll be able to commerce an enormous account profitably you must commerce a small account profitably, and it actually is healthier you begin on a small account first anyhow. The purpose is, profitable merchants are at all times considering like a hedge fund, they’re within the mindset on a regular basis. Don’t turn into consumed with getting cash quick, as a substitute, turn into consumed with buying and selling correctly and successful and also you’ll earn cash far sooner.

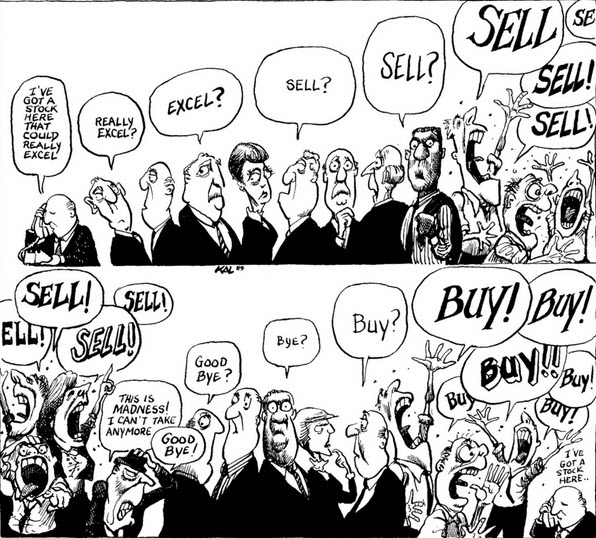

We Exploit Herd Conduct

The ‘herd’ is a typical time period used within the buying and selling world after we check with the plenty of starting / novice merchants who are likely to lose cash. The purpose of any dealer is to maneuver from one of many herd to at least one that sometimes does reverse of the herd or maybe I ought to say a ‘shepherd’, one who leads the herd. The primary level to grasp is that the herd normally find yourself dropping cash, you don’t wish to be a part of the them.

The ‘herd’ is a typical time period used within the buying and selling world after we check with the plenty of starting / novice merchants who are likely to lose cash. The purpose of any dealer is to maneuver from one of many herd to at least one that sometimes does reverse of the herd or maybe I ought to say a ‘shepherd’, one who leads the herd. The primary level to grasp is that the herd normally find yourself dropping cash, you don’t wish to be a part of the them.

Because of this, I’ve written articles on how you can be a contrarian dealer, as a result of I want to commerce opposite to the herd most often. Contrarian can truly are available two types out there….

- We’re not afraid to purchase new highs or promote new lows

Sarcastically, while nice merchants are contrarian thinkers (doing the alternative to the gang), typically truly going with the herd and following large strikes out there could be the contrarian factor to do, as a result of everyone else is trying to wager in opposition to the transfer.

How typically do markets pattern a lot additional than you suppose they’ll? Fairly often, a market will get into a powerful pattern and unsuccessful merchants will proceed to wager in opposition to that pattern just because they give you every kind of the reason why it ‘can’t maintain going’.

“The market can keep irrational longer than you’ll be able to keep solvent.” – John Maynard Keynes

- Take the opposite aspect of the herd

The apparent and commonest contrarian commerce is to take the opposite aspect of the crowded commerce (market transferring right into a key stage), we fade that transfer (fade, which means promote into energy or purchase into weak point). We all know that most individuals get the market strikes flawed, so we leap on the alternative aspect, both blindly at a key stage or with a worth motion sign to verify an entry.

We Don’t day commerce

Profitable merchants are not often day merchants. There are numerous causes why I ‘hate’ day buying and selling, however the greatest one is solely that it’s a lot more durable to earn cash constantly as a day dealer than it’s as a swing dealer or place dealer.

Most profitable merchants are what are referred to as swing or place merchants, which mainly means we maintain positions for a number of days and even weeks, using swings out there and making an attempt to revenue on them. That is in stark distinction to a day dealer who geese out and in of the market a number of occasions on a day, making an attempt to take tiny positive factors from every commerce.

We deal with the every day chart timeframe as place merchants as a result of we all know it’s an important and profitable timeframe to commerce. I personally spend most of my chart time on the every day chart, second is the weekly and third is the 4 hour, often, I have a look at the 1 hour however by no means do I under that.

Within the chart under, discover on the left we have now a 15-minute chart vs. a every day chart on the best. This is similar market, the EURUSD. You’re looking at nearly 5 months of worth knowledge on the every day chart (every bar is a day) vs. the 15-minute chart which is displaying you just a few days. That alone ought to let you know which chart is extra important and highly effective. For those who don’t perceive why, please try this text on the energy of the every day chart:

A low-frequency buying and selling strategy is what you might want to undertake if you wish to turn into a profitable dealer. Keep in mind what I stated within the introduction? Effectively, what do most merchants do? They commerce quite a bit. Most merchants lose cash as you recognize, so that you wish to commerce much less often if you wish to be worthwhile. One typically over-looked cause that many merchants lose cash because of buying and selling quite a bit, is as a result of they get eaten up by the unfold. Continually coming into and exiting trades provides as much as huge transaction prices (known as the Foreign exchange unfold) and for many merchants this simply throws extra grime on the grave they’re digging for themselves by over-trading (it’s an enormous unseen buying and selling value over time).

All of the above factors on why skilled merchants don’t day commerce lead me to my subsequent sub-point: muddle vs. readability. You see, having a cluttered buying and selling strategy the place you’re buying and selling on a regular basis and utilizing many various strategies (particularly buying and selling with indicators) leads to psychological muddle. Chart muddle and buying and selling methodology muddle lead to psychological muddle which results in confusion and second-guessing, this all results in dropping trades and dropping cash. Profitable merchants stick to the technique they’ve used and have faith in, they sometimes solely have a handful of ‘instruments’ they use of their toolbox. I at all times recommend merchants grasp one commerce setup at a time in order that they study which of them they like greatest after which stick to these.

In any case, you don’t wish to find yourself like this man, proper? 🙂

We Hardly Commerce at All

One factor that separates profitable merchants from dropping merchants, is that profitable merchants don’t commerce quite a bit, the truth is, we hardly commerce in any respect. The ‘huge boys’ commerce like snipers, not machine gunners as a result of we all know that’s the way you protect buying and selling capital lengthy sufficient to reap the benefits of huge market strikes.

Starting merchants typically don’t perceive the truth that being flat (not in) the market is a place. Keep in mind; no place is usually one of the best place. It’s worthwhile to have self-discipline and persistence to excel at buying and selling and that is constructed by means of ready and solely taking high-quality setups and studying to ENJOY passing on low-quality trades or when there isn’t any buying and selling edge current.

The nice Warren Buffet teaches this very same strategy. For those who’ve by no means heard of his “Punch-card” idea, here’s what he says about it:

“”I may enhance your final monetary welfare by supplying you with a ticket with solely twenty slots in it so that you simply had twenty punches – representing all of the investments that you simply bought to make in a lifetime. And when you’d punched by means of the cardboard, you couldn’t make any extra investments in any respect. Underneath these guidelines, you’d actually think twice about what you probably did, and also you’d be pressured to load up on what you’d actually considered. So, you’d achieve this a lot better.” – Warren Buffet

Discover that he says, “you’d be pressured to load up on what you’d actually considered”. It is a crucial a part of my private strategy. I don’t take many trades in any respect, however once I do, I consider in them as a result of they meet me pre-defined standards or I’ve researched them and I’m assured in them, so I ‘load up’ and I am going in huge. Have in mind, you can not commerce this manner should you’re buying and selling fairly often, however you additionally don’t have to commerce quite a bit; one huge winner a month or each three months even, could make you sufficient revenue if you recognize what you’re doing.

We Use Wider Stops

Since I commerce the every day charts more often than not, I run my stops in line with every day chart worth motion setups and to the dynamics of the every day chart worth motion. The every day chart has wider every day ranges of worth motion (naturally) so we have to have wider cease losses than we’d on an intraday chart in order that we depart room for the market to maneuver and never cease us out prematurely.

As we are able to see under, merchants can use the common true vary (atr) in addition to close by ranges to assist place their cease losses at protected ranges on the charts (wider than what you’re in all probability used to) so that they don’t get stopped out prematurely. Profitable merchants use huge stops as a result of they know the pure every day worth fluctuations can cease them out earlier than their positions get an opportunity to take off of their favor.

Within the chart under, discover that worth moved barely past the low of the pin bar sign within the chart, earlier than rocketing up in favor of the commerce. An expert dealer is aware of that worth will typically simply violate the low or excessive of a sign earlier than transferring of their favor, that is one cause they select to make use of wider stops than an novice who would probably put the cease precisely on the pin bar low (which might have resulted in a loss). Wider is healthier with reference to stops!

We all know what we’re buying and selling forward of time

The very best merchants anticipate the market, they don’t simply react to it. I wrote about this extensively in a latest article on how you can construct a buying and selling plan round anticipation, however I’ll talk about it briefly once more right here…

Profitable merchants commerce like a predator, sitting on the sidelines and ready to pounce on their prey like a tiger. Our buying and selling plan pre-defines the situations we’re in search of, and as we map out the market prematurely we see if it meets these situations or not. This offers us one thing to remain accountable to in order that we aren’t simply buying and selling on a whim on a regular basis we open our charts. All we have to do is await the market to ‘stroll into our lure’, so to talk.

We measure ourselves on R not % Returns

Profitable merchants deal with buying and selling, not on the cash. By doing this, we primarily make buying and selling right into a recreation or competitors, and it’s us in opposition to the world. It’s important to play it proper to win, and should you make a mistake, the results are very actual. Thus, we measure ourselves based mostly on R, not on pips or percentages. By R, I’m speaking about threat / reward the place R = threat and success is measured in multiples of it. So, a 2R winner means we risked R and doubled our threat to make 2R. To study extra about this idea, try this text: Measure income in R, not pips or percentages

Conclusion

I’m not going to fake that the above factors are all you might want to turn into a profitable dealer, however I’ll say that except you pay attention to these core concepts and implement them into your buying and selling, your probabilities of success are enormously lowered. With sixteen years of expertise buying and selling and markets and 9 years instructing folks how you can commerce, I see it as my obligation to instill into you the concepts, processes and perception methods that I’ve had success with and that I do know others have had success with (together with a few of the members of our buying and selling neighborhood) since I launched this weblog again in 2008.

Changing into a profitable dealer isn’t essentially troublesome however one factor is crystal clear, should you don’t suppose and act just like the successful merchants whom you’re competing in opposition to, you’ll get chewed up and spit out sooner than you suppose. It’s time to cease being naive and begin considering in a different way if you wish to have an actual shot at getting cash as a dealer. Ask your self one query; should you do no matter everyone else is doing and suppose how everyone else is considering, what’s going to you get? You’ll solely find yourself like them, and as merchants, we must be considering and performing in a different way from the ‘herd’ (who lose) to realize an edge and turn into profitable. I hope the guidelines and insights in at the moment’s article assist offer you a greater understanding of a few of the methods skilled merchants suppose and act as a way to begin performing extra just like the ‘shepherd’ and fewer like one of many ‘herd’.

Now I Would Actually Love To Hear What You Thought Of This Lesson ? Please Depart Your Feedback & Suggestions Beneath …

If You Have Any Questions, Please E-mail Me Right here.