Tailed bars are a very powerful bars on a value chart. Plain and easy. The explanation they’re so vital is as a result of they usually give us a really robust clue as to what value would possibly do subsequent, extra so than another kind of value bar.

Tailed bars are a very powerful bars on a value chart. Plain and easy. The explanation they’re so vital is as a result of they usually give us a really robust clue as to what value would possibly do subsequent, extra so than another kind of value bar.

At present’s lesson is a abstract of my favourite tailed-bar candlestick patterns. These are the identical patterns that I search for once I analyze the charts and that I commerce often. You’ll study what these patterns appear to be and tips on how to establish them in addition to what they imply. This will probably be an ideal introduction into totally different tailed bar candlestick methods for freshmen, but additionally, it’s a wonderful refresher for those who have already got a primary thought of how I commerce and what I search for on the charts each day.

This lesson does depend on you figuring out the fundamentals of candlestick charts and candlesticks nevertheless, so for those who aren’t too aware of this matter then please checkout my candlestick chart tutorial for extra data. I’m not going to enter element on particular entry and exits utilizing the patterns mentioned in the present day as a result of that could be a entire matter unto itself, however I do increase on this in nice element in different articles and in my value motion buying and selling programs.

Now, let’s get began in studying about a few of the finest tailed bar candlestick buying and selling patterns…

What are tailed bars?

A tailed bar is considerably subjective in nature, however what I imply once I confer with “tailed bars” is a bar with a tail that’s noticeably longer than the physique or actual physique (space between the open and shutting value).

The tails of value bars, typically referred to as shadows or wicks, are vital to decipher due to what they present and what they suggest. They present rejection of a degree or value space and both a small, medium or massive reversal that occurred fairly shortly. This reveals us that there was exhaustion at that space the tail fashioned, which has huge implications. Once we see an space value is changing into exhausted at, it means there’s something taking place that we have to be aware of. That tail is exhibiting us that both patrons actually needed to purchase there, or sellers actually needed to promote, why doesn’t actually matter, we solely care in regards to the what and the how.

A tail on a bar implies that value MIGHT transfer in the other way, and shortly. That is clearly an enormous piece of knowledge for a value motion dealer, and you may truthfully base your complete buying and selling method round tailed bars if you’d like. Every day chart bars are, in my view, a very powerful bars and consequently, each day chart tailed bars are a very powerful bars of all. If you’re unfamiliar with why each day charts are so vital, please learn my each day chart buying and selling tutorial earlier than transferring on.

Even when we don’t have a particularly clear tailed value motion sign like (my favourite) a pin bar sample or maybe a fakey pin bar combo sign, we are able to nonetheless collect an amazing quantity of knowledge from easy tailed bars, which we are going to go over shortly.

In brief, tailed value bars are your buddy, maybe your BEST FRIEND out there, and I recommend you get as near them as doable, it’s essential ‘fall in love’ with them and I recommend you make them the one factor you grasp to succeed at buying and selling.

Examples of tailed bar candlestick patterns:

The Basic Pin Bar Candlestick Sample

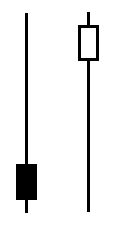

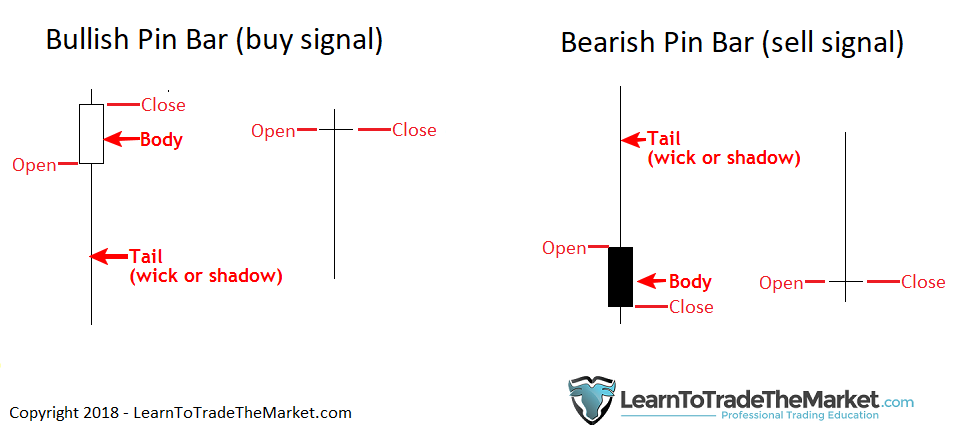

The pin bar candlestick sample is a tailed bar that reveals a pointy reversal in value throughout the time interval of the chart. So, a each day chart pin bar is exhibiting a pointy value reversal throughout that day interval, whereas a 1-hour pin bar reveals a reversal in value throughout a 1-hour interval. The upper the time-frame, the extra ‘weight’ a sign carries, or the extra vital it’s.

The pin bar usually has a for much longer tail than the physique, the physique is the space between the open and shut. The tail on a pin bar needs to be no less than 2/3 the size of the full bar, ideally 3/4. Typically, there’s little or no physique, as within the second pin bars depicted beneath. Listed below are examples of a few totally different trying pin bars that each have the identical which means; a reversal in value has occurred, represented by the lengthy tail. The implication is that value could transfer the opposite path, reverse the tail…

- Right here’s a real-world instance of the traditional pin bar candlestick sample:

The Lengthy-tailed Pin Bar Candlestick Sample

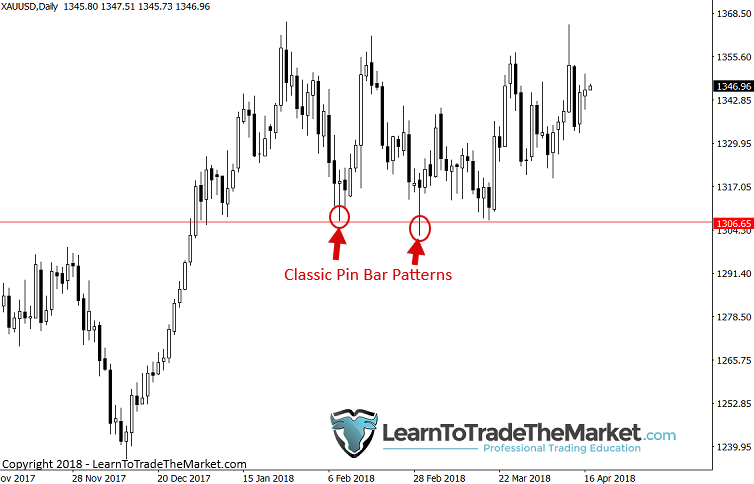

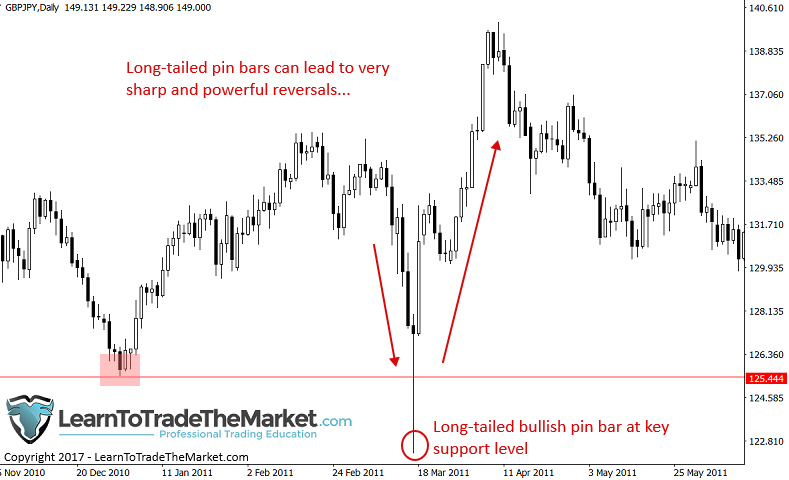

A protracted-tailed pin bar sample is precisely what its identify implies; a pin with an unusually lengthy tail on it. These are maybe a very powerful bars in all of buying and selling, and they’re uncommon as nicely. While you see a long-tailed pin bar, cease and take discover as a result of it’s an enormous clue that value goes to swing within the different path. Lengthy-tailed pins usually mark main directional modifications out there and even main pattern modifications.

Lengthy-tailed pin bars usually have a smaller actual physique than a traditional pin bar. Their tails are all the time considerably longer than any close by bars and as such, they’re not possible to overlook. They’re typically good candidates for coming into on a 50% retrace per my commerce entry trick technique. Listed below are a few examples of splendid trying long-tailed pin bars. For these of you who’re new: Bullish means it’s a possible purchase sign and bearish means a possible promote sign…

- Right here’s a real-world instance of a long-tailed pin bar candlestick sample:

- One other instance of a traditional long-tailed pin bar candlestick sample:

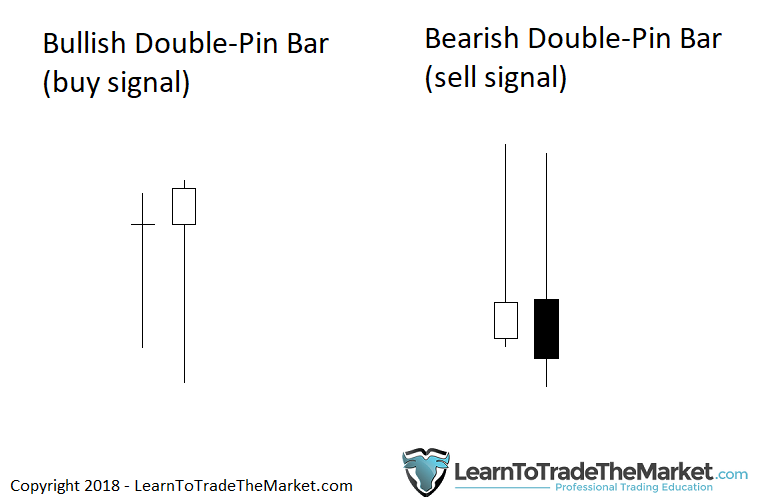

Double Pin Bar Candlestick Sample

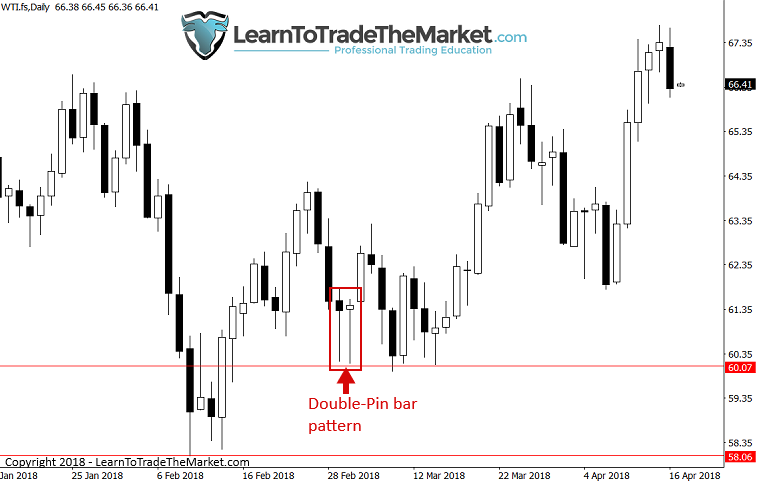

It’s not unusual to see consecutive pin bars kind in a market, usually at key chart assist and resistance ranges because the market is ‘testing’ these areas to see which social gathering goes to win between the bulls and bears (patrons and sellers). You’ll extra generally see double pin bars or two pin bars back-to-back, however I’ve even seen three in a row earlier than, however that’s uncommon. Double-pins are one thing to take very robust discover of as a result of fashioned throughout the correct market context and with confluence, they are often an apparent warning sign that value is about to surge the opposite path. Here’s what they appear to be…

- Right here’s a real-world instance of a double pin bar candlestick sample:

Notice: It’s possible you’ll discover value simply barely violated the lows of the double-pin bar sample pictured. This occurs typically and it’s why it’s essential totally perceive correct cease loss placement in your trades earlier than you begin buying and selling dwell. The right cease loss, a wide-enough one, would have stored you from getting stopped out earlier than the commerce went on to be an enormous winner…

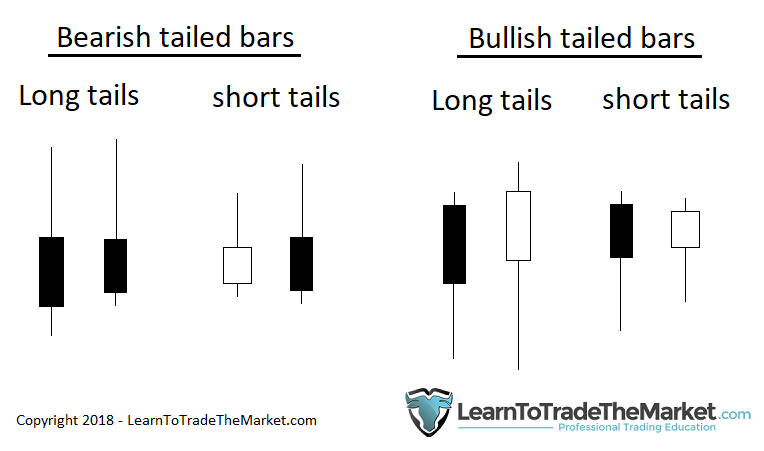

Small tailed bars and Lengthy tailed bars (not pin bars)

The next diagram reveals what I merely confer with as “tailed bars”. These are bars with vital tails however that aren’t excellent sufficient to be thought of a “pin bar sign”. As I mentioned within the opening; tails are sometimes vital, so we have to take a look at any tailed bar as probably having an influence on near-term market path, even when they aren’t excellent pin bar alerts. I’ve devoted a complete new chapter in my course to this tailed bar “phenomenon”.

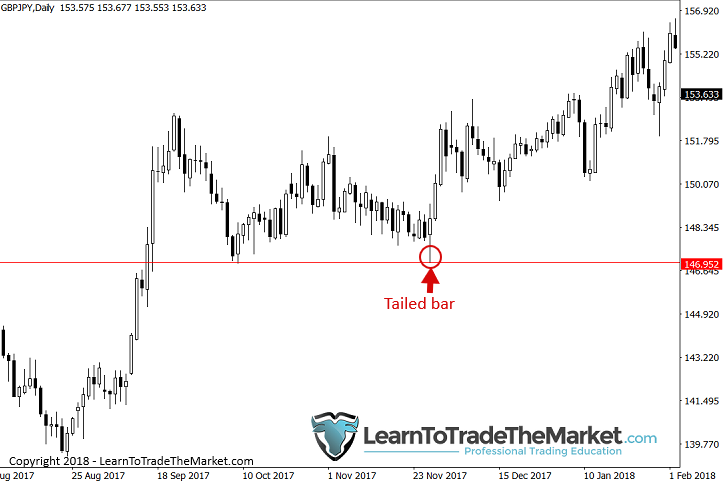

- The chart beneath reveals a reasonably ‘traditional’ tailed bar. This was a bullish tailed bar that fashioned at a assist degree inside an general up-trending market; we are able to see it result in a powerful push larger. Notice, it was not a bullish pin bar as a result of the decrease tail wasn’t fairly lengthy sufficient in relation to the physique and its higher tail was a bit too lengthy. However, nonetheless, the decrease tail was lengthy sufficient to categorise it has a “bullish tailed bar” …

- Within the subsequent picture, you’ll be able to see the variations between an extended and small tailed bar in addition to traditional pin bar patterns…

Different tailed bar candlestick patterns

There are different tailed bar patterns that I get into extra in-depth in my course, however for now, let’s take a look at a few of the extra widespread ones briefly.

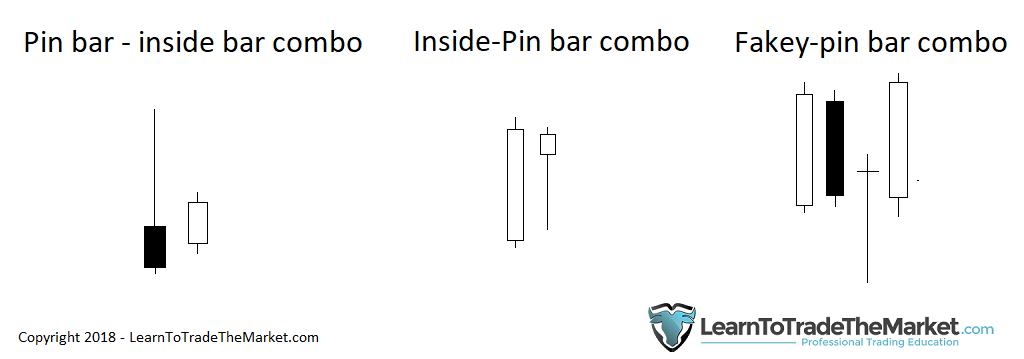

Under, you will note a pin bar inside bar combo sample, that is the place an inside bar sample varieties after a pin bar and throughout the pin’s construction. Subsequent, you will note an inside-pin bar sample, now don’t get confused, this isn’t the identical because the earlier combo sample, that is the place you could have a pin bar that’s ALSO an inside bar, so it’s an inside bar sample the place the within bar is a pin, basically it’s handled identical to an inside bar sample with a bit added ‘weight’ since you could have that pin bar as an additional piece of confluence. Lastly, now we have a fakey pin bar combo setup the place the fakey or false-break a part of the fakey sample can be a pin bar.

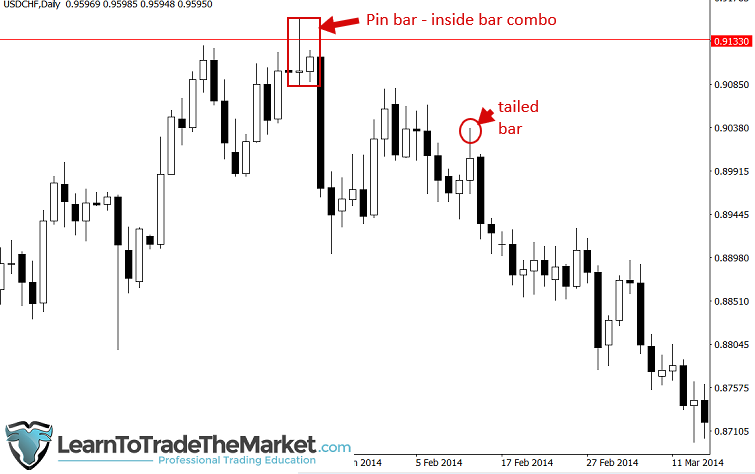

- Under, we are able to see a real-world instance of a bearish pin bar inside bar combo sample. This led to a big decline because the sample implied. Additionally, discover the bearish tailed bar that adopted, one other good promote sign in that downtrend…

- Right here’s a real-world instance of an inside-pin bar combo candlestick sample:

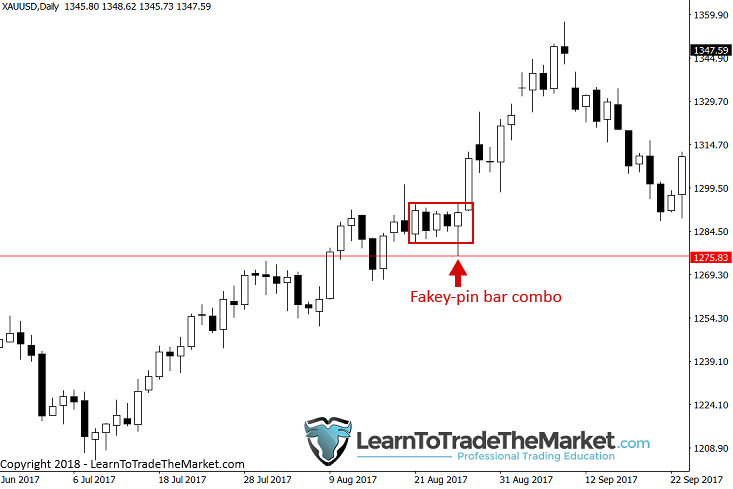

- Right here’s a real-world instance of a fakey-pin bar combo candlestick sample:

Conclusion

I hope you could have loved this tutorial on tailed bar candlestick patterns and what they imply. It was a short introduction to those patterns, however you must have realized sufficient to start out figuring out them on the charts and working towards them in your demo account.

I get into these patterns and much more in a lot higher element in my complete value motion buying and selling mastery course. We go in-depth on tips on how to enter trades utilizing these patterns, figuring out the right chart context through which to enter them and ‘affirm’ our entry, in addition to understanding tips on how to filter the alerts in numerous market circumstances. Successfully, I train you to learn the charts from left to proper, very like you learn a guide, which is a key component in worthwhile buying and selling.

What did you consider this lesson? Please share it with us within the feedback beneath!