Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has skilled important volatility in current days, pushed largely by escalating geopolitical tensions within the Center East. After breaking down from the vary that had held since early Could, ETH fell sharply to $2,100, triggering widespread concern amongst buyers. The breakdown was largely attributed to the market’s response to the US assault on Iranian nuclear services, which escalated the battle between Israel and Iran.

Associated Studying

Nevertheless, markets rapidly responded to constructive developments. Ethereum rebounded strongly above the $2,400 degree following studies that Iran and Israel had agreed to a ceasefire, quickly easing world threat sentiment. This reduction rally introduced new optimism to the Ethereum market, particularly amid indicators of institutional confidence.

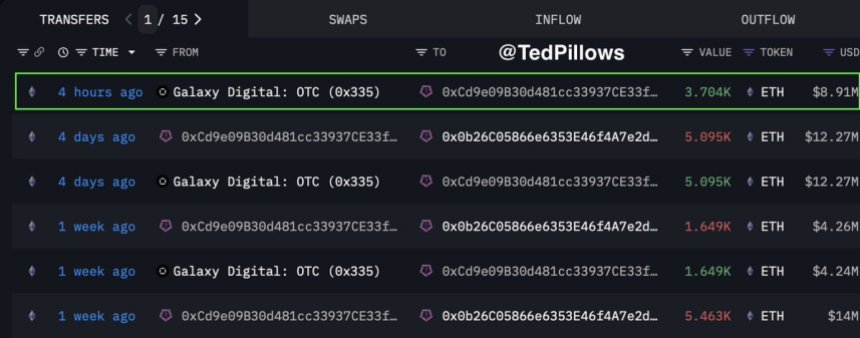

In accordance with knowledge shared by high analyst Ted Pillows, a significant whale or institutional entity bought one other $8.91 million value of ETH, persevering with an aggressive accumulation streak. Over the previous three weeks, this similar entity has reportedly purchased $422 million in Ethereum, signaling robust conviction regardless of current market stress. This wave of accumulation means that long-term gamers might view the present value zone as a key alternative, reinforcing the concept that Ethereum may very well be constructing a base for its subsequent main transfer as soon as broader circumstances stabilize.

Ethereum Surges As Ceasefire Ignites Market Optimism

Ethereum surged over 14% following studies of a ceasefire settlement between Israel and Iran, offering a much-needed reduction rally after weeks of geopolitical rigidity and uncertainty. The information sparked a wave of bullish momentum throughout the market, with ETH rebounding sharply from current lows close to $2,100 to commerce firmly above the $2,400 mark. Bulls, who had misplaced management amid panic promoting, at the moment are displaying indicators of power because the market prepares for its subsequent decisive transfer.

Regardless of this rebound, warning stays. The broader macroeconomic setting continues to tighten, with rising issues over a possible US recession, excessive Treasury yields, and sustained hawkishness from the Federal Reserve. These elements may weigh on threat belongings within the weeks forward, placing Ethereum’s rally to the check. Nonetheless, optimism is constructing, particularly round the opportunity of the long-awaited altseason—one which many consider can be led by Ethereum.

Including gas to this narrative is the rising development of whale accumulation. In accordance with insights shared by analyst Ted Pillows, a significant whale or institutional entity has simply acquired one other $8.91 million value of ETH. This buy provides to a staggering $422 million in Ethereum collected over the previous three weeks.

Such aggressive shopping for suggests that enormous gamers are positioning themselves for a significant transfer forward, probably anticipating Ethereum to be on the forefront of the following market cycle. As ETH consolidates above key ranges, the buildup development may act as a foundational drive supporting increased costs, particularly if macro and geopolitical dangers stabilize.

Associated Studying

ETH Reclaims $2,400 Following Sharp Rebound

Ethereum has reclaimed the $2,400 degree after a swift rebound from a breakdown close to $2,100. The current candle construction on the 3-day chart exhibits a powerful wick to the draw back, adopted by a restoration, reflecting the affect of geopolitical developments, most notably the ceasefire between Iran and Israel. This bounce prevented a deeper selloff and has introduced Ethereum again above a key psychological degree.

Trying on the chart, ETH stays below stress from the 100-day and 200-day shifting averages, at the moment performing as resistance across the $2,638 and $2,779 zones. Worth additionally not too long ago broke a short-term descending trendline and is now trying to consolidate above it. This means the potential for a development reversal if bulls can maintain momentum and push by means of the shifting common cluster.

Associated Studying

Quantity stays subdued however exhibits indicators of restoration, signaling early curiosity returning after the fear-driven flush. A break and shut above the $2,600 vary would probably open the trail to retest the $2,800 zone, which was a significant provide space in earlier months.

Featured picture from Dall-E, chart from TradingView