A big crypto pockets that lately took a pointy loss on Ethereum has restructured its holdings, transferring away from risky tokens and growing publicity to stablecoins and tokenized gold, in keeping with on-chain monitoring knowledge.

Associated Studying

The handle drew consideration after an aggressive Ethereum buy late final 12 months went incorrect. Between November 3 and November 7, 2025, the pockets spent about $110 million to accumulate 31,005 ETH at a mean value of $3,581.

As costs slid, the place was unwound. Almost all the holding was offered for roughly $92.19 million, locking in a loss near $18 million inside two weeks. At present costs close to $3,020, that very same Ethereum stack would now be valued at round $93.6 million.

Shift Away From Ether After Expensive Exit

Based mostly on studies from blockchain monitoring platforms, the sell-off marked a transparent change in conduct. The pockets, as soon as closely tied to Ethereum, now not holds a big directional guess on the asset. As a substitute, balances have been unfold throughout cash-like tokens and commodities. The transfer displays warning relatively than an try to shortly get well losses.

An unknown whale, who misplaced $18.8M on $ETH in simply 2 weeks, has deserted $ETH and rotated into #gold.

The whale has spent $14.58M to purchase 3,299 $XAUT at $4,421 over the previous 7 hours.https://t.co/hit6agWmHd pic.twitter.com/X7k94zV0iQ

— Lookonchain (@lookonchain) January 2, 2026

Gold Shopping for Reveals Choice For Decrease Volatility

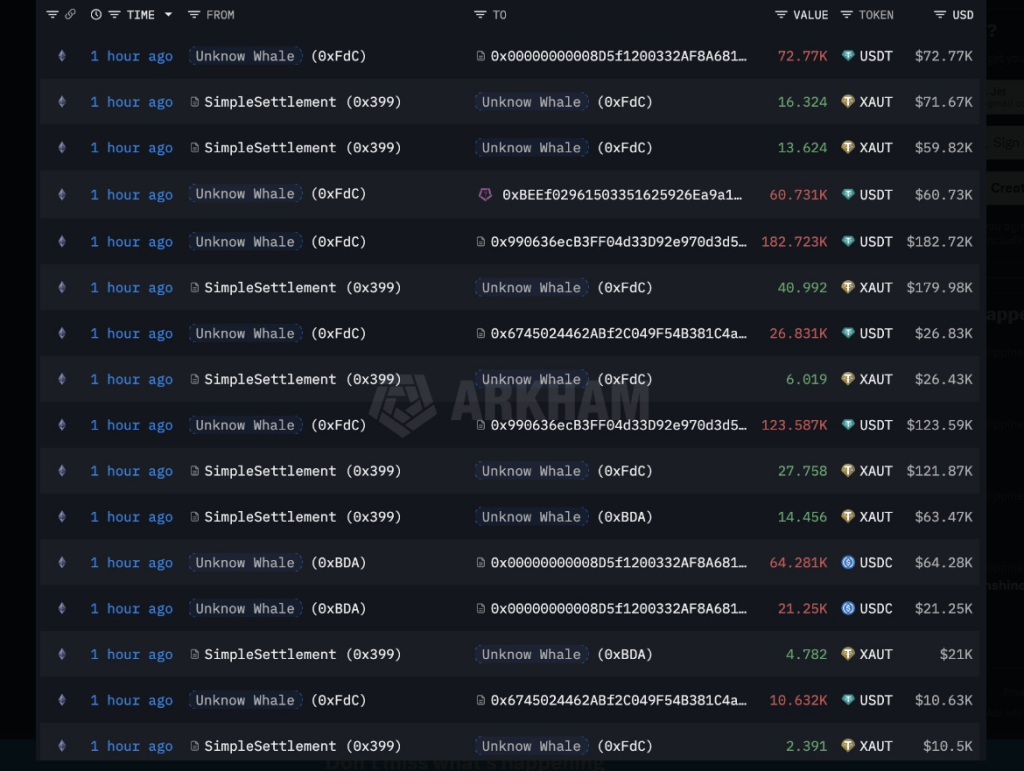

In line with on-chain information, the handle started constructing a place in Tether’s tokenized gold product, XAUT. Beginning on Friday, the pockets spent $14.58 million in USDT to purchase 3,299 XAUT throughout a number of transactions.

The common buy value got here in close to $4,421 per token. This was not the primary gold purchase. A smaller XAUT acquisition was made on December 13, roughly three weeks earlier. As of the newest knowledge, the pockets holds 3,386 XAUT tokens value about $14.92 million.

The broader portfolio now totals near $91 million. About $58 million sits in USDT, one other $18 million is held in USDC, whereas the rest is break up between XAUT and a lowered Ethereum stability. The composition factors to capital safety relatively than high-risk positioning.

Metals Outperform Crypto In 2025

Returns from final 12 months assist clarify the change. Stories have disclosed that Bitcoin fell by 6% in 2025, whereas Ethereum dropped 11%. Over the identical interval, gold surged over 60%, and silver rose a fair steeper 147%.

Associated Studying

Main inventory indexes such because the S&P 500, Dow Jones, and Nasdaq 100 additionally posted stronger efficiency than a lot of the crypto market. With these ends in view, some buyers seem extra comfy holding belongings linked to metals or money.

In the meantime, analysts at asset supervisor VanEck have pointed to 2026 as a attainable restoration 12 months for the crypto market. Their view contrasts with the present conduct of enormous wallets transferring into stablecoins and gold-linked tokens.

The divide exhibits how unsure sentiment stays after a 12 months when metals and conventional belongings delivered stronger beneficial properties than main cryptocurrencies.

Featured picture from Unsplash, chart from TradingView